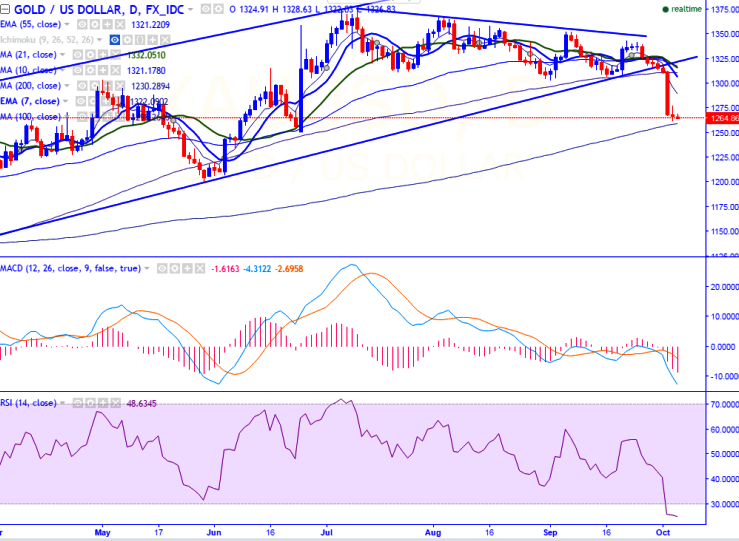

- Major support - $1258 (200- day MA).

- Gold hits fresh two-week low yesterday on account of the high dollar . It has declined till $1261.90 yesterday and slightly recovered from that level. It is currently trading around $1264.904.

- The greenback strengthened once again after the release of U.S ISM services index data. The index rose to 57.1 last month compared to August’s reading of 51.4 fastest in 11 months.

- Market awaits US Non-Farm-Payroll data on Friday for further direction.

- Technically, any break below 61.8% retracement will drag the gold down till $1258 (200- day MA)/$1250 (38.2 %retracement of $1046 and $1375) in the short term.

- On the higher side, resistance is around $1279.50 (3- day EMA) will take the yellow metal to $1385 (23.6% retracement of $1375.30 and $1266.99)/$1302 (9- day EMA). It should close above $1300 for further upside.

It is good to buy on dips around $1260-$1262 with SL around $1250 for the TP of $1285/$1292/$1300