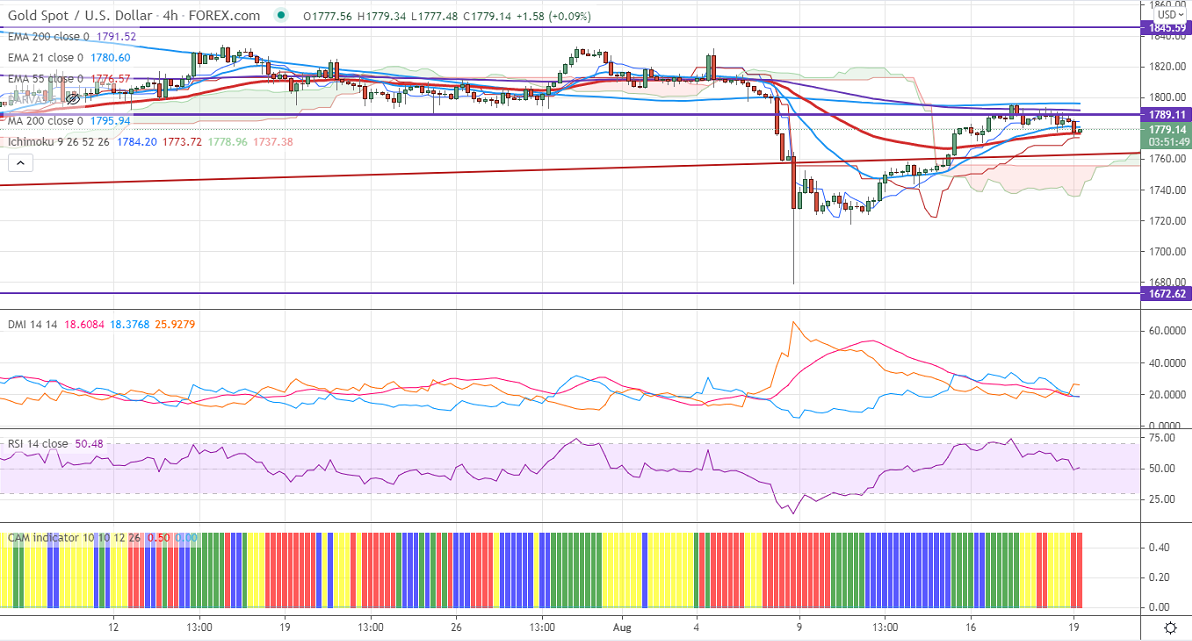

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1784

Kijun-Sen- $1773

Gold has lost more than $10 after Fed meeting minutes. The minutes show that Fed officials debated about timing and plans to reduce the bond-buying program this year. But some participants felt that "substantial further progress" toward the maximum-employment goal had not yet been met. The US dollar index surged sharply and hits a 4-1/2 months high. The Yellow metal hits a low of $1774 and is currently trading around $1778. Market eyes US Philly fed manufacturing index, initial jobless claims data for further direction.

Factors to watch for gold price action-

Global stock market- Weak (positive for gold)

US dollar index – Bullish (negative for gold)

US10-year bond yield- mixed (neutral for gold)

Technical:

The immediate resistance is around $1800, a convincing break above will take the yellow metal $1835/$1860 is possible. It is facing strong support at $1770, violation below targets $1762/$1750.

It is good to buy on dips for around $1775-76 with SL around $1760 for TP of $1831.