Gold futures prices inched up around $3.00, or 0.2%, to $1,277.04 a troy ounce.

The yellow metal finished down $13.30, or around 1% in the recent past but still booked a weekly gain of about 0.4%, marking its first weekly rise in that past four weeks.

OTC Outlook and Options Strategy:

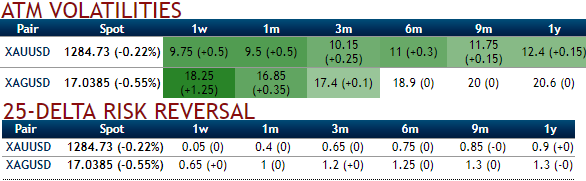

Please be noted that the gold's implied volatility is perceived to be comparatively minimal from other its previous flashes (below 9.50% in 1m tenors) along with bearish neutral risk reversal sentiments, accordingly we construct a multiple legs of option strategy for regular traders of this currency cross when there is little IV.

XAUUSD's lower IVs with bullish neutral delta risk reversals could be interpreted as the option writer’s opportunity in short run. Thus, exploiting on lower IVs we eye on shorting calls with shorter expiries which would lock in certain yields by initial receipts of premiums.

A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

Using options expiring on the same expiration month, the options trader creates an iron condor by selling a lower strike OTM put and buying an even lower strike out-of-the-money put, similarly shorting a higher strike OTM call and buying another even higher strike out-of-the-money call.

This results in a net credit to put on the trade.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data