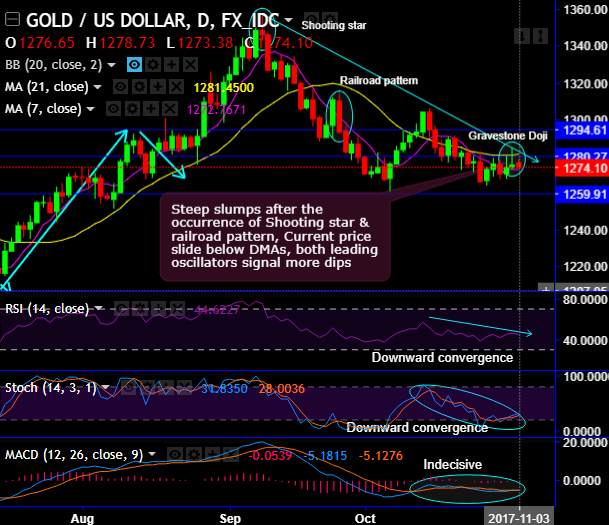

Steep slumps in gold prices have been observed after the occurrence of the shooting star and railroad pattern at $1,346, $1,293.75 and $1,294.75 levels, these bearish patterns hampered previous bullish momentum.

As a result, the current prices slide below 21DMAs, both leading & lagging oscillators signal more dips.

Every attempt of upswings is restrained below 21DMAs from last 1 week.

Stiff resistance is observed at 1,280 – 1,295 levels.

On a broader perspective, after 2-years of the consolidation phase, the major trend now seems to be exhausted again at 38.2% Fibonacci retracement levels with stern bearish swings. As the bulls failed to show the sustenance above this Fibonacci levels and 100-DMAs, the major downtrend now goes non-directional but likely to resume.

RSI on this timeframe, shows faded strength in the consolidation phase, while stochastic curves have been indecisive.

Both lagging indicators have been indecisive that indicates no clarity for trend.

Well, in addition to that, the four Fed-related corrections so far this year averaged sell-offs of $28/oz, $58/oz, $76/oz and $84/oz each, with the current sell-off surpassing $50/oz so far. Considering the higher starting point, we believe the downside trade has room to play out further.

While further weakness in the broad dollar and re-escalation of political tensions could lend some support to bullion prices, we continue to caution against holding gold as a political hedge during the global rate normalization cycle.

Trading tips:

Any abrupt rallies in gold price should be snapped by cautious bears in as soon as the price touches $1281.64 (21DMA) where it sees stiff resistance.

On intraday speculative grounds, contemplating above technical reasoning, we advise tunnel spreads which are binary versions of the debit put spreads.

At spot reference: $1,276, this strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at $1,281.14 (21DMA) and lower strikes at $1,270 levels.

Alternatively, shorts in CME gold futures for Dec’17 delivery have been encouraged at a price of $1,318/oz mid-September. We continue to uphold the position for the commensurate trade target upto $1,190/oz with a strict stop 1 at $1,294/oz and stop 2 at $1,306.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand