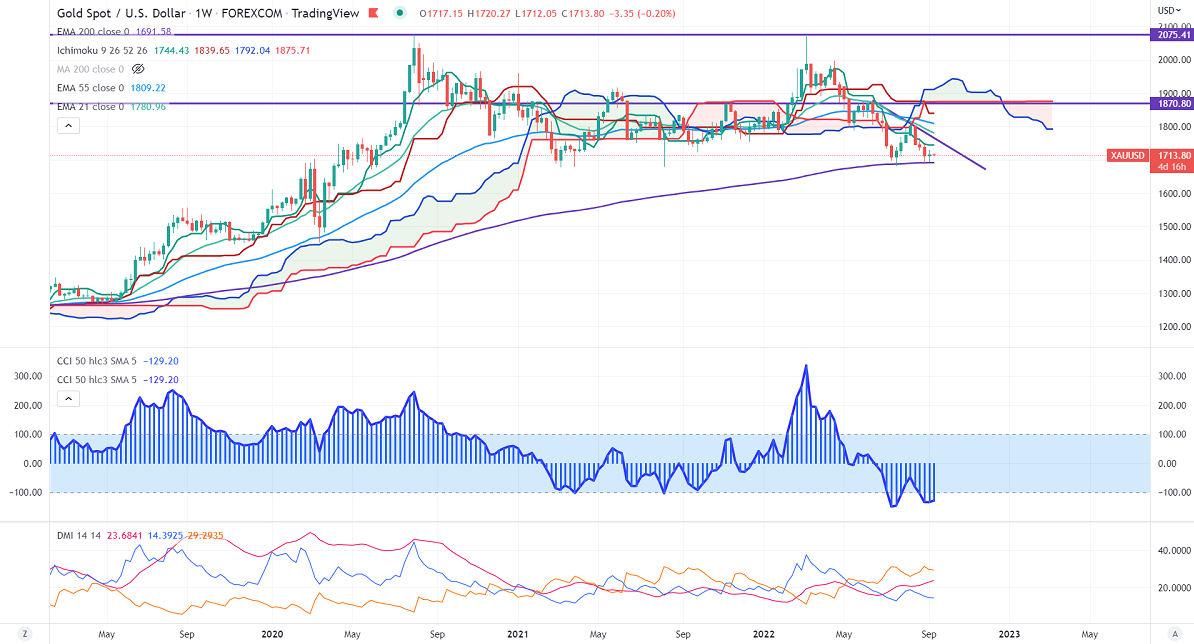

Ichimoku Analysis (Weekly Chart)

Tenken-Sen- $1744.43

Kijun-Sen- $1839.65

Gold pared some of its gains on surging US treasury yields. European central bank and Bank of Canada increased rates by 75 bpbs and hinted at further rate hikes. The overall trend is still bullish as long as support of $1680 holds.

The number of people who have filed for unemployment benefits fell by 6000 last week to a three-week low of 222K vs. an estimate of 234000.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Sep rose to 90% from 57% a week ago.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index – Bullish (Negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $1690, a close below targets $1671/$1650/$1600—significant reversal only below $1650. The yellow metal faces minor resistance around $1720, breach above will take it to the next level of $1740/$1760/$1775/$1800/$1820.

It is good to buy on dips around $1678-80 with SL at around $1650 for TP of $1750/$1775.