The bullion market has seen more turbulence today, Gold and silver saw a turnaround from crucial levels in the last few days as a December rate hike got fully factored in and as geopolitical concerns emerged yet again.

The short-term action could be choppy going forward for both gold and silver given that US data remains strong at a time when geopolitical tensions are ramping up again.

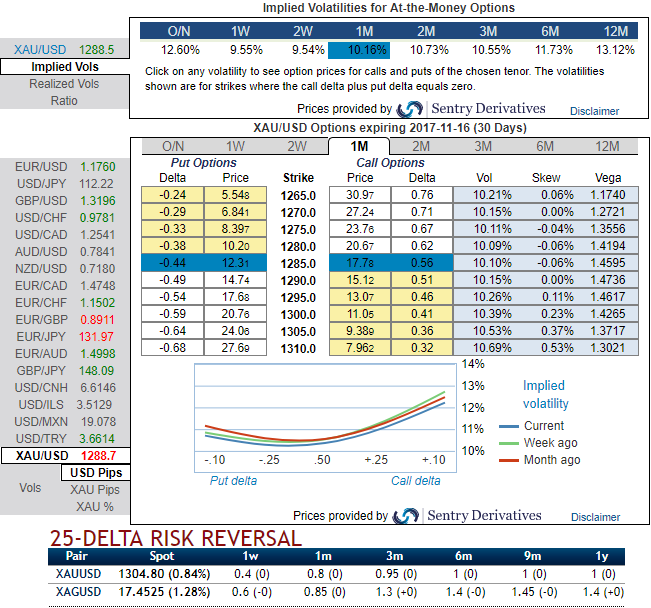

Well, the positive skews in 1m implied volatilities signify hedging interests in upside risks and risk reversals of this tenor also suggest upside risks.

Please be noted that the 1m (1%) ITM put is priced over 16% more than the NPV, whereas the IVs of 1m tenor is just shy above 10.15%, thus, it is deemed as the notable disparity between the pricing and IVs.

Hence, this disparity is coupled with the combination of IV skews, bullish neutral RRs and the trend of this underlying commodity suggest credit put spreads that is likely to favor both upswings in short run and major downtrend.

The yellow metal price seems to be extending the rebound in the short run, but rallies likely to be restrained near immediate resistances at $1382 (38.2% Fib.Ret from the lows of $1046.54). On the flip side, the crucial supports are near $1280 and if break below this level could stimulate the selling sentiments in the medium run.

Positively IV skews and bullish neutral risk reversal of 1m tenors lure below options strategy:

Option Trade Recommendations (Credit Put Spreads):

All the factors are discounted in FX options market, you could make out this in mounting risk sentiments as you could see the positively skewed IVs in OTM put strikes in 1m tenors (refer positive IV skews indicate the strikes at 1301-1310 which is as per the choice of ITM put writing).

The XAU (gold) volatility market normalized sharply (you could observe that in XAUDUSD IV skews across all tenors) and IV skewness is quite favorable for OTM call option holders, synthesizing this with ongoing trend of this pair, we eye on writing overpriced in the money put options that likely to reduce hedging costs of long legs.

At spot reference: $1285, one can also deploy diagonal credit put spreads by writing 1m (1%) in the money put while initiating longs in 3m at the money put, the structure could be constructed at the net credit.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different