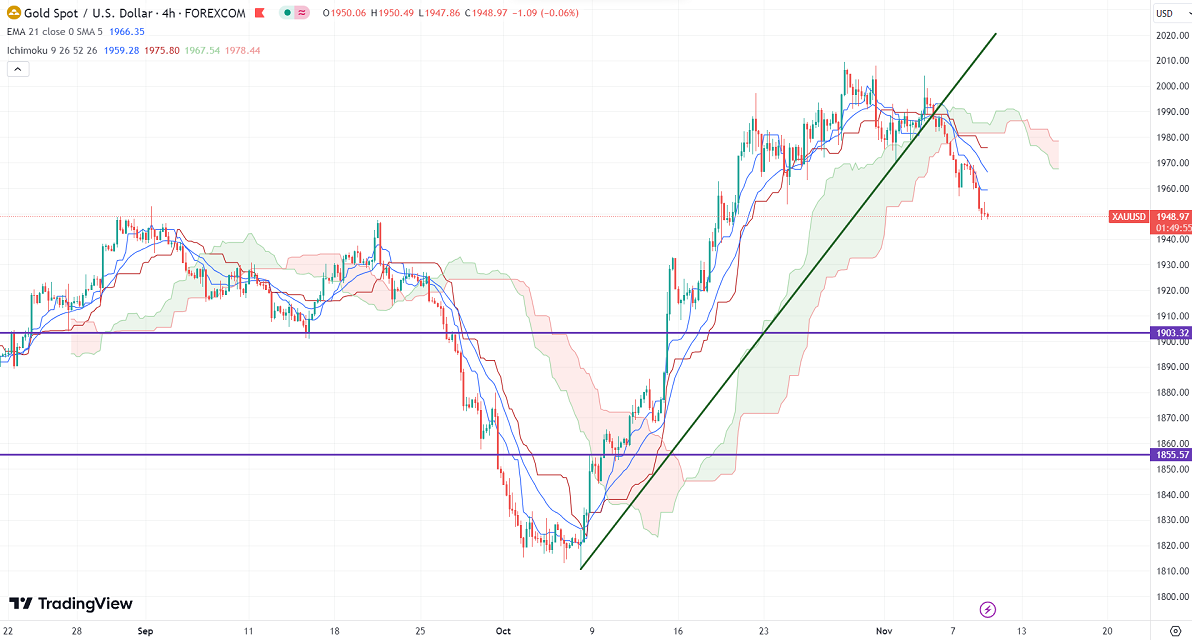

Ichimoku Analysis (4 hour chart)

Tenken-Sen- $1959.28

Kijun-Sen- $1975.80

Gold trades below $1950 ahead of Fed chairman speech. It hit a low of $1947.59 and is currently trading around $1948.92.

The hawkish comments from Fed Reserve Governor Michelle Bowman and Federal Reserve Chicago President Austan Goolsbee also put pressure on the yellow metals. Markets eye the Fed chairman's speech today for further movement.

Major Economic data for the day

Nov 9th, 2023, Fed Chair Powell Speaks (7 pm GMT)

US jobless claims (1:30 pm GMT)

US dollar index- Bearish. Minor support around 104.80/104. The near-term resistance is 106.25/107.50.

According to the CME Fed watch tool, the probability of a no-rate hike in Nov increased to 90.4% from 79.50% a week ago.

The US 10-year yield lost more than 10% from multi week top. The US 10 and 2-year spread widened to -44% from -16%.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index - Bearish (positive for gold)

US10-year bond yield- Bearish (positive for gold)

Technical:

The near–term support is around $1945, a break below targets of $1926/$1900. The yellow metal faces minor resistance around $19 and a breach above will take it to the next level of $2020/$2048.

It is good to sell on rallies around $1960 with SL around $1970 for TP of $1927.