Ichimoku analysis (Daily chart)

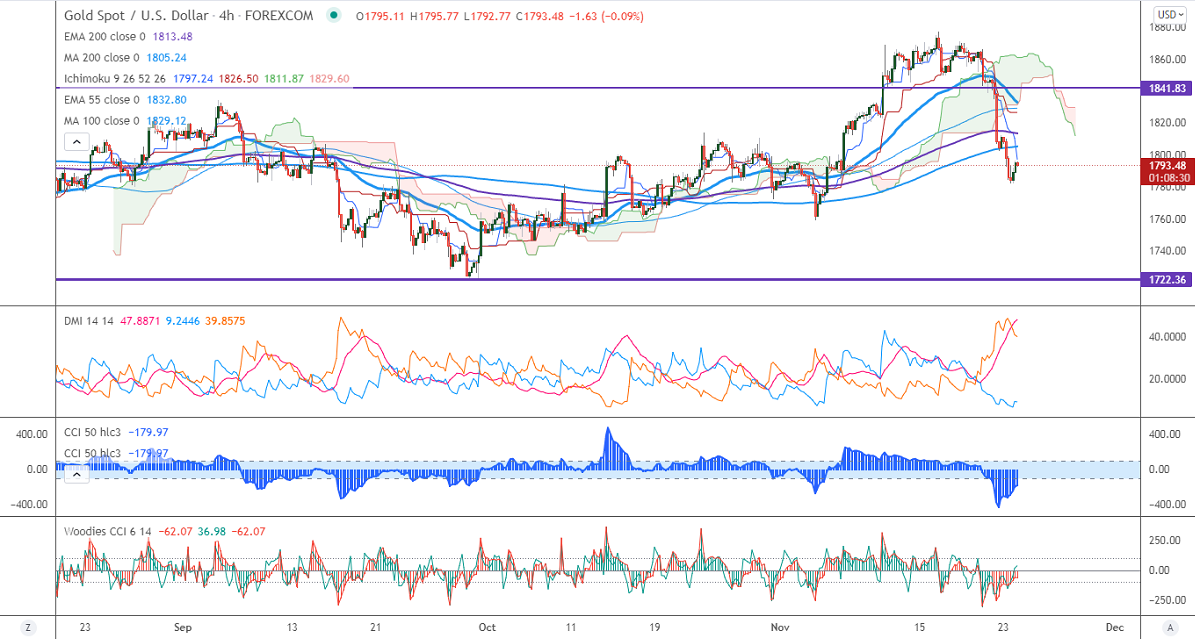

Tenken-Sen- $1810.34

Kijun-Sen- $1826.50

Gold continues to trade weak for fourth consecutive days and lost more than 4.5% on strong US yield. The re-election of Jerome Powell for another four years is pushing US Treasury yields and the US dollar higher. The IHS Markit flash Manufacturing slowed mildly to 59.10 compared to a forecast of 59.30. Markets eye US prelim GDP and Core PCE index for further direction. It hits a low of $1782.03 and is currently trading around $1793.60.

Factors to watch for gold price action-

Global stock market- Bullish (Negative for gold)

US dollar index –Bullish (Negative for gold)

US10-year bond yield- Bullish (Negative for gold)

Technical:

It faces strong support at $1780, violation below targets $1770/$1758/$1740. Significant trend continuation only below $1675. The yellow metal facing strong resistance $1805, any breach above will take to the next level $1815/$1825/$1835/$1860 is possible.

It is good to sell on rallies around $1815-16 with SL around $1825 for TP of $1760.