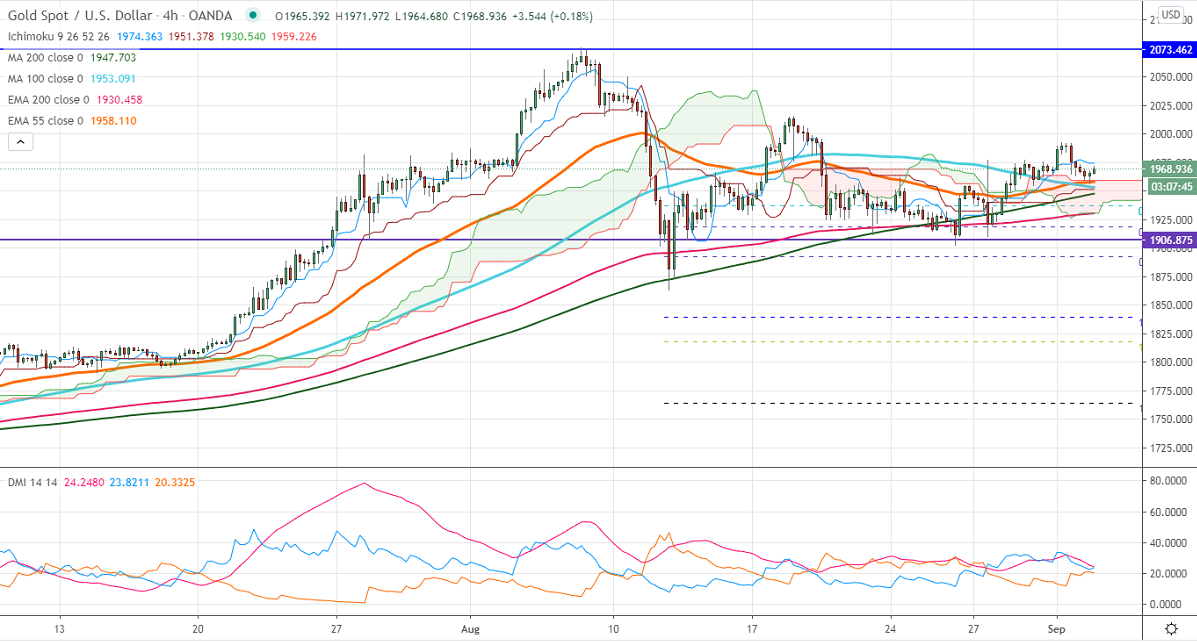

Ichimoku Analysis (4- Hour Chart)

Tenken-Sen- $1974

Kijun-Sen- $1951

Gold declined more than $30 from a high of $1992 on the strong US dollar. The US dollar index recovered after a slight upbeat US ISM manufacturing index. The manufacturing index came at 56 at Aug highest level in 7 months. The Dollar index jumped more than 50 pips from minor bottom 91.75. Markets eye US ADP employment data for further direction. The US 10-year yield declined more than 10%, the real yield is at -1.08% from -1.03% yesterday.

US Dollar Index –Bullish (Positive for yellow metal)

S&P500- Positive (negative for gold)

US Bond yield- negative (positive for gold)

Technical:

The immediate support is around $1947, any indicative break below targets $1943/$1918. Major weakness only if it breaks below $1900.The near term resistance is at $2000, the violation above will take to the next level $2015/$2085.

It is good to buy on dips around $1935-40 with SL $1900 for the TP of $2015.