Over the weekend, the price of precious yellow metal has taken strong support at $1,747 levels and travelling northwards that is on the verge of multi-years’ highs.

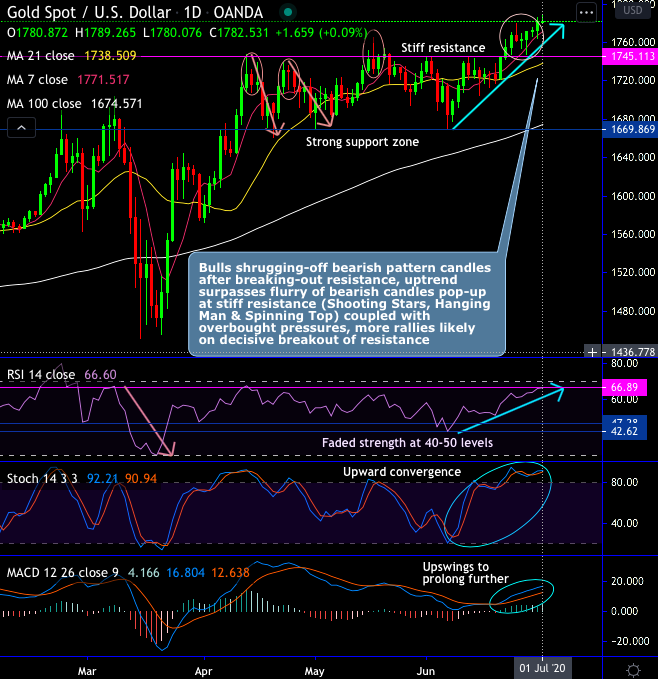

Currently, XAUUSD is trading at $1,780 levels which is shy away from 8-years highs. Technically, bulls are shrugging-off bearish pattern candles after breaking-out of striff resistance of 1745 levels, while the uptrend surpasses flurry of bearish candles pop-up at stiff resistance (Shooting Stars, Hanging Man & Spinning Top) coupled with overbought pressures, more rallies likely on decisive breakout of resistance (refer daily chart).

Leading oscillators (RSI & Stochastic curves) show upward convergence to these prevailing rallies to indicate intensified buying momentum. Bullish DMA & MACD crossovers also substantiates this uptrend.

On a broader perspective, the bulls, in the major trend, have been extending saucer pattern, but the upswings seem to be exhausted at 88.6% Fibonacci retracement levels upon sharp shooting star formation (refer monthly chart).

While both the leading and lagging oscillators, on this timeframe, substantiate upswings.

Trade tips: At spot reference: $1,780 level, on trading grounds, we advocate one touch call options trading strategy with upper strikes at $1,796 levels. One can achieve certain yields as the underlying spot FX keeps spiking towards upper strike on the expiration.

Alternatively, on hedging grounds, we advocated long positions CME gold futures contracts, we uphold the same strategy by rolling over these contracts for July’20 deliveries as we could foresee more upside risks and intensified buying interests on safe-haven sentiments amid coronavirus pandemic and the global financial crisis.