How things will progress for EURUSD not only depends on how the lingering conflict between the US and the EU develops further. Negative effects on the economies due to the uncertainty of whether there will be an escalation or not can already be expected now. What matters for the exchange rate is how pronounced the difference of these will be between the economies of the eurozone compared with the US. If this were to remain the case that clearly suggests that the US dollar would gain the upper hand. After all, the Fed is already much more hawkish than the ECB and in that case, the divide may very well widen further.

While the EONIA curve continues to price too benign a rate hike path – about 12bp of cumulative hike by December 2019 and around 30bp/year thereafter for the next couple of years; keep paying Dec’19 ECB OIS.

Hedge risk of a delayed start to the hiking cycle by being long Dec19, EURIBOR in the 6M wide fly. ECB sources quoted in media reports suggest QE reinvestment flows will be biased at the ultra-long end of the curve challenging our bias for a flatter swap spread curve

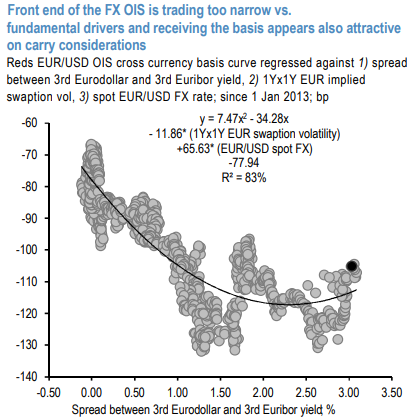

In line with swap rates, EURUSD cross-currency basis has also exhibited large volatility over the last month, especially at the front end of the curve. For instance, 1Y basis has rebounded around 15bp since the end-May lows.

Anecdotal evidence suggests that this sharp correction has been primarily due to stop out of legacy received positions (facilitated by ECB’s announcement of the end of QE). At current levels, front-end bases are close to their narrowest levels since the ECB started QE purchases.

The analysis shows that the front end of the basis curve, and more specifically, the FX OIS basis are now trading too narrow (around 6-7bp) versus fundamental drivers such as USD/EUR money market yield spread, rates volatility, and FX (refer above chart).

The expectations of a wider Eurodollar/Euribor spread should exert marginal narrowing pressure (given current levels and positive convexity).

However, we believe that the current narrow valuations are already consistent with a much stronger spot FX and/or wider spread. Thus, we are biased towards wider front-end EURUSD bases. Additionally, receiving the basis at the front-end also offers positive carry. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 74 levels (which is bullish), while hourly USD spot index was at shy above -29 (mildly bearish) while articulating (at 14:25 GMT). For more details on the index, please refer below weblink:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes