It is difficult for us to know why the market decided to react to the positive German GDP data by buying the euro and to price in a marginally higher likelihood of the first ECB rate step in late 2018.

First of all the data for the eurozone came in in line with expectations and the ECB is unlikely to base any steps on developments in one individual country but will always look at the entire eurozone if it takes monetary policy decisions.

Secondly, the ECB sounded pleased with the economic recovery in the eurozone, but in its view, the inflation is still too weak so that it stuck to its expansionary approach at the end of October and made it clear that rate hikes are a long way off. That means the market should focus more on price data.

The same applies to the dollar. The US producer prices that were published yesterday rose notably in October, but consumer prices that are on the agenda for today will cause the FOMC members to frown as they are unlikely to have risen much in October.

The Fed will nonetheless stick to its rate hike in December - and the market has priced that in almost completely now. However, as the market is unlikely to adjust its longer-term rate expectations until the inflation rates rises

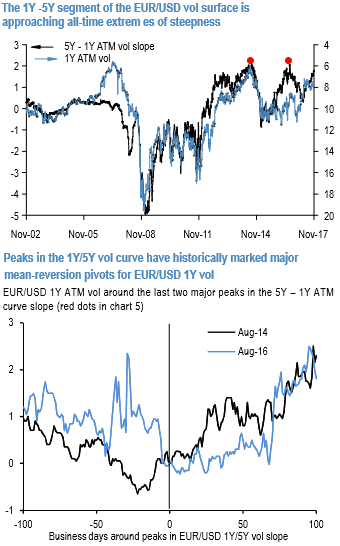

For investors unwilling to risk missing what is potentially a once-a-decade move in vol for the sake of finessing a few tenths in entry levels, we recommend beginning to scale into vega longs via 6M6M forward volatility (FVAs).

6M6M forward vols in EURUSD are priced cheap to the rest of the surface (refer above chart) owing to the richness of 6M options relative to surrounding tenors, which in turn is on account of the punchy (30%) overnight vol priced in for the Italian election next March that falls within the 6-mo expiry window.

The event-related bump means that the term structure of forward vol is sharply upward sloping up to 6M expiries but flattens out thereafter (refer above chart), making static slide optics on FVAs spanning the 6M-1Y segment of the curve especially attractive.

FVAs, of course, underperform outright vega longs when vols are in motion, so they need to be supplemented by outright 1Y straddles/vol swaps when the core mean-reversion move in vol gets underway. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is gaining traction displaying shy above 158 levels (extremely bullish), while hourly USD spot index was inching lower towards -74 (bearish) while articulating (at 09:43 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

Hence, bulls may resume any time upon these indications.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures