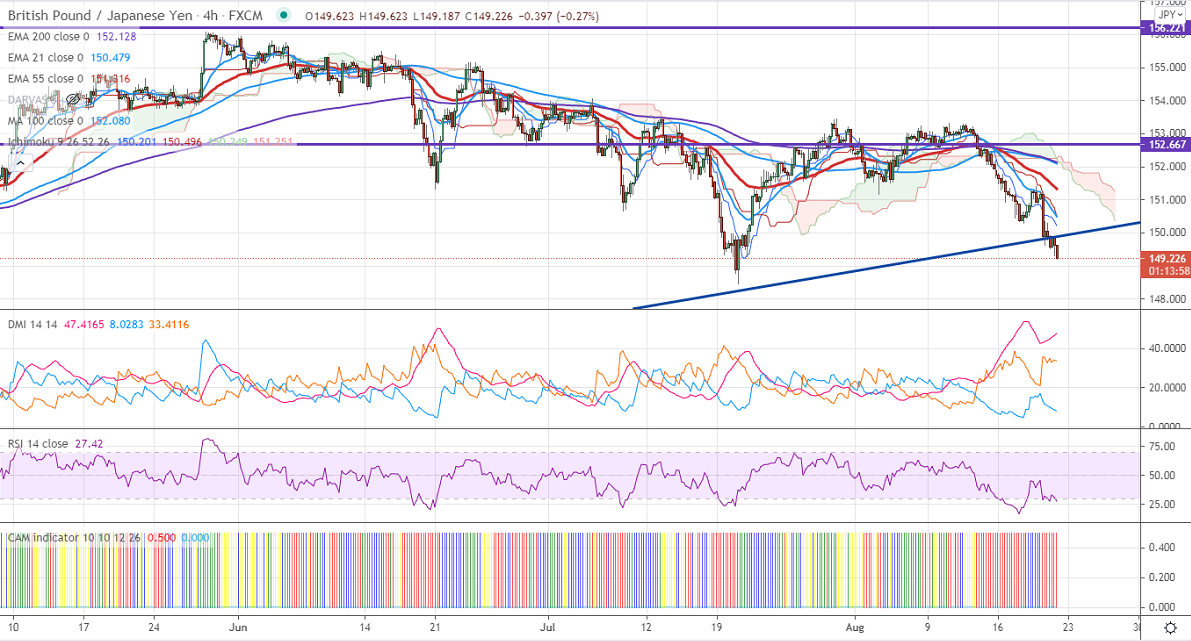

Ichimoku Analysis (Hourly Chart)

Tenken-Sen- 151.42

Kijun-Sen- 150.95

Previous week high – 153.45

GBPJPY has broken significant trend line support and holding well below that level. The pound sterling inching towards 1.3600 after dismal UK retail sales data. It has dropped by -2.5% in July compared to a forecast of 0.2%. The intraday trend of GBPJPY is bearish as long as resistance 150.60 holds.

USDJPY- Analysis

Holding below 110 levels. Major resistance to watch 110.80. Significant support is around 109.

GBPUSD- Bearish

The pair is trading well below 200-day MA, a dip till 1.3570 possible.

Technical:

The pair's immediate resistance is around 150.22, any jump above targets 150.60/151/151.55. Significant bullish continuation if it breaks 153.50. On the lower side, near-term support is around 149. Any indicative violation below targets 148/147.40.

Ichimoku Analysis- The pair is trading below Kijun-Sen and Tenken-Sen.

Indicator (Hourly chart)

CAM indicator-Bearish

Directional movement index –Bearish

It is good to sell on rallies around 151 with SL around 151.55 for a TP of 149.