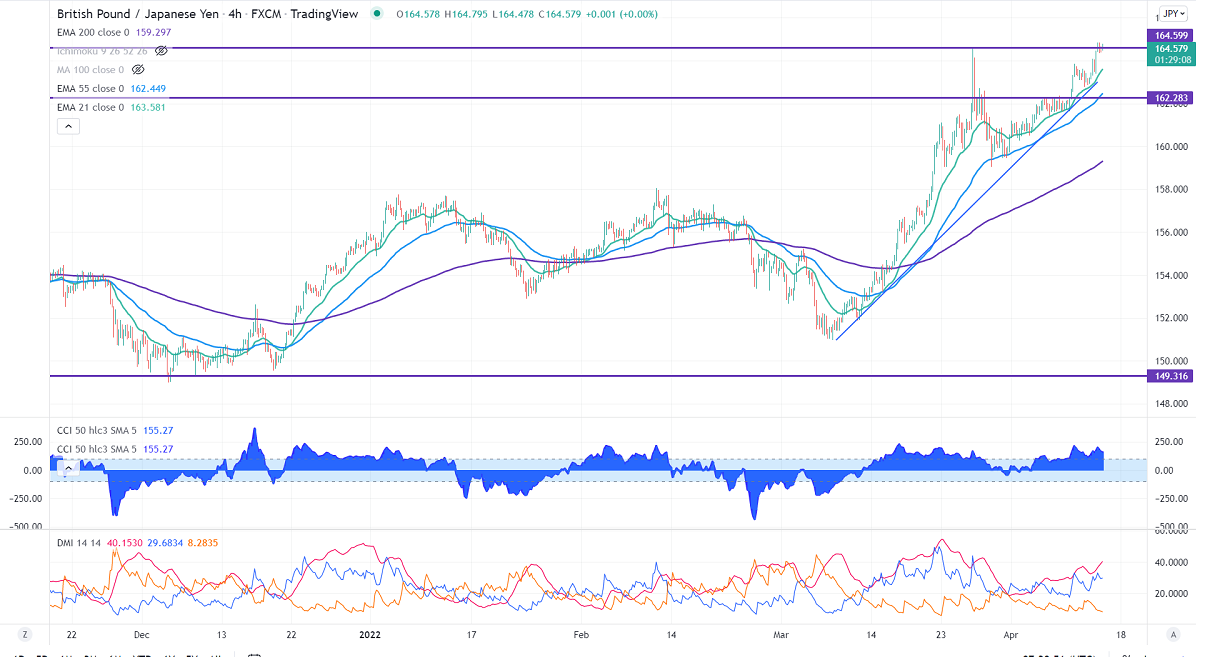

GBPJPY hits 2-1/2 weeks high on surging pound sterling. It gained sharply against USD on upbeat UK CPI data. The annual inflation rate rose to 7% in Mar compared to 6.2% in Feb, its highest in 30 years. Any close above 1.3200 confirms further bullishness. GBPJPY hits an intraday high of 163.84 and is currently trading around 163.40.

USDJPY

USDJPY holds above 125 level on surging US Treasury yields. Any intraday weakness is only below 125.

Technicals:

On the lower side, immediate support is around 162.80, breach below will drag the pair to the next level to 162/161.40/160.50/159.70/159. The minor resistance to be watched is around 164, a break above that level confirms intraday bullishness, and a jump to 166 is possible.

It is good to buy on dips around 164 with SL around 163 for the TP of 166.