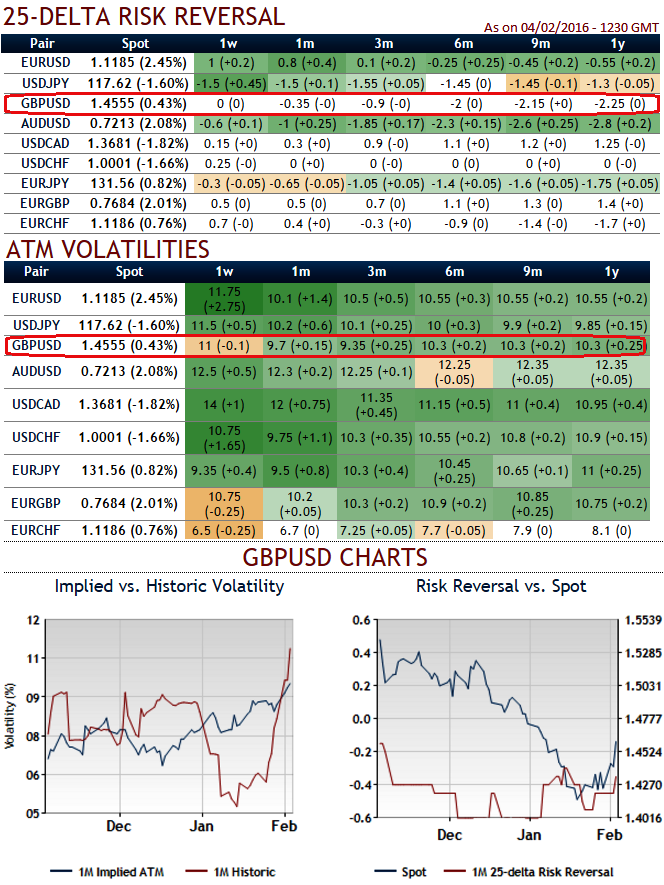

GBP vols ahead of UK Brexit risk: suspicious but not panicky The eruption of Brexit threats on the GBP vol scene can be traced in delta risk reversals. Way back in October and November even though 3M ATM IVs were tepid but tend to increase in the fears of Brexit pressures, during that period, while our aggregate VXY G7 FX vol index dropped -0.5vols, 3M GBP/USD vols spiked up +1.0vols.

But for now, OTC hedging arrangements for downside risks are intensifying 3M IVs have been reducing.

That a referendum on UK exit would take place in the near future was always a known fact since the Conservative Party won the General Elections. PM Cameron's letter to the European Council on Nov 10 and subsequent political declarations brought concerns surrounding UK exit from the EU to the forefront of investors' preoccupations and crystallized the expected referendum schedule around the summer 2016 - as evidenced by a historic steepening in GBP FX vols in the 6M-9M range.

The vol price action in the beginning of the year was that of a more homogeneous vol rally, as market turmoil fueled by global growth concerns, China woes and the extension of the commodities sell-off has lifted vols across the board.

A synthetic measure of GBP/G10 vols is currently back to levels last seen around the Jan 2015 SNB de-peg and ECB QE spell of volatility. Since the YTD FX vol rally is a generalized one, GBP vols do not stand out in particular, and Brexit fears are diluted within the generalized rise in risk premia. It is not yet the case that vols in GBP crosses are at extreme levels, especially given the disruptive nature of a Brexit scenario.

There is much more risk embedded in GBP risk reversals by comparison, as current aggregate levels of GBP RRs are overtaking the extremes of the pre-Scottish referendum scare and the UK General Elections, and match the summer 2011 sell-off episode.

While there hasn't been a formal announcement on the actual date, media reports have cited officials mentioning a 16-week period necessary to organize the referendum once a deal is worked out with the EU, which PM Cameron expects to happen at the Feb 18-19 meeting. This does make June a clear possibility, but a delay to September is very likely as well.

For now, we would still recommend a GBP/USD 3M risk reversal i/o 1Y as a generic hedge for Brexit risk. The ideal entry point is not ideal given the near doubling of the risk reversal since early October, but the bias is for further widening of the skew in 1H on slow-bleed demand for event protection.

FxWirePro: GBP baffles in OTC on Brexit speculations, which one would you rely upon IVs or risk reversals?

Friday, February 5, 2016 11:00 AM UTC

Editor's Picks

- Market Data

Most Popular

7