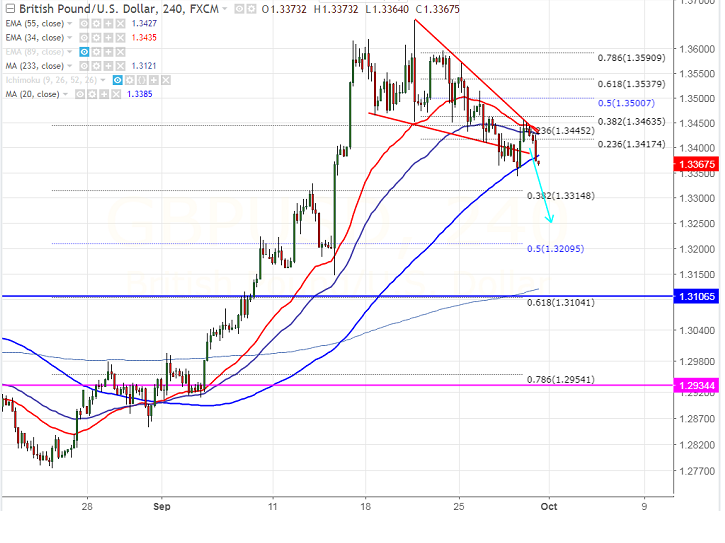

- Cable has declined once again below 1.3400 after weaker than expected UK GDP data. The pair has formed temporary top around 1.36574 on Sep 20th and started to decline from that level. The pair hits low of 1.33429 yesterday and shown a minor recovery till 1.34550.The pair declined till 1.3380 at the time of writing and is currently trading around 1.33735.

- UK economy recorded its weakest year on year growth since 2013 in the three months to the end of June. UK GDP slowed to 1.5% in the second quarter from 1.8%.

- On the lower side, nearby support is around 1.3340 and any break below will drag the pair down till 1.33140 (38.2% retracement of 1.27739 and 1.36570)/1.3250. The pair is trading slightly below cloud bottom in four hour chart.

- The near term resistance is around 1.34635 (38.2% fibo) and any break above will take the 1.3500/1.3570 (Sep 25th 2017 high).

It is good to sell on rallies around 1.3410-15 with SL around 1.3465 for the TP of 1.3315/1.32550.