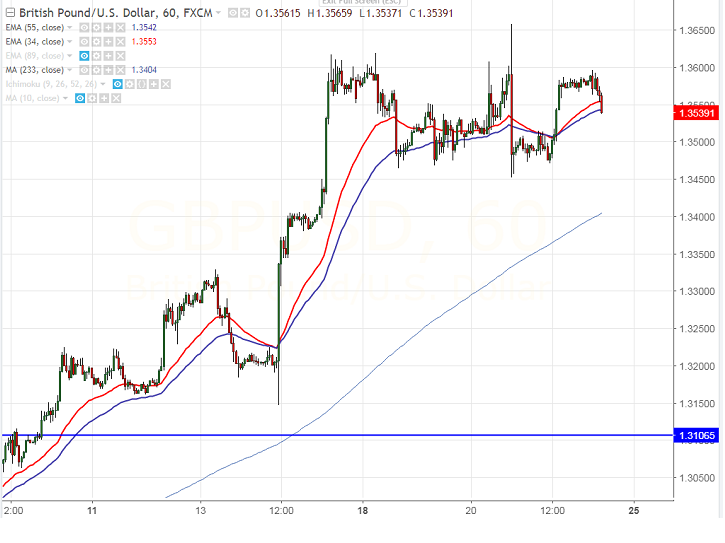

- GBP/USD rebounds yesterday after hitting low of 1.34700. The pair jumped till 1.35850 and is currently trading around 1.35467.

- Market awaits UK PM Theresa May speech on Brexit later today for further direction. Theresa May is expected to give an overview of Brexit negotiations and markets expect some softer exit from EU.

- The pair on the higher side is facing major resistance around 1.3660 and any break above will take the pair to next level to 1.3700/1.3800 level.

- The near term psychological support is around 1.3500 and any break below will drag the pair down till 1.34500/1.3400. Any break below 1.3400 (233- HMA) will confirm minor bearishness.

It is good to buy on dips 1.3460-65 with SL around 1.3400 for the TP of 1.3660.