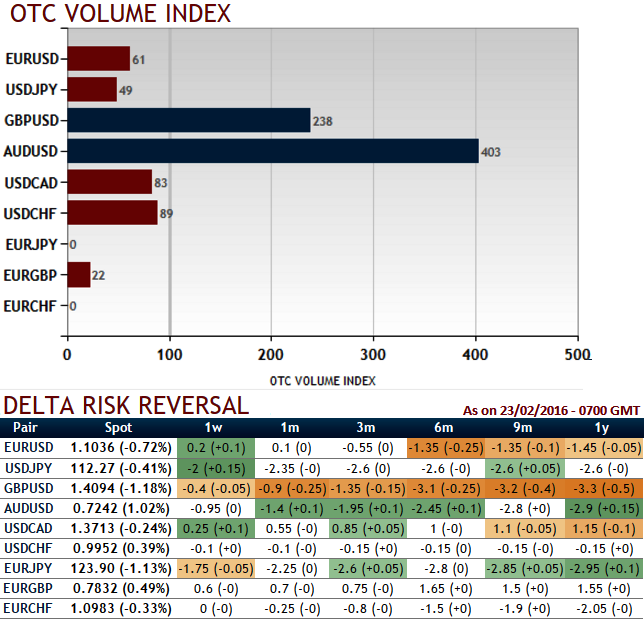

Please observe as to how the delta risk reversal numbers are getting higher negative values gradually in a long run (flashing at -3.3 for 1 year expiries). Volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

In the FX option market, prices are quoted for standard moneyness levels for different time to expiry periods. These standard moneyness levels are At the money level, 25 delta out of the money level and 25 delta in the money level (75 delta) .

Since out of the money levels are liquid moneyness levels in the options market, market quotes these levels as 25 delta call and 25 delta put . If a trader has the right model, he can build the whole volatility smile for any time to expiry by using the three points in the volatility surface.

To justify this stance, see the OTC VIX for GBPUSD as we observe the spiking volumes of standard contracts taking place in the over-the-counter (OTC) FX options market. This OTC volume index indicates total numbers of traded contracts in the past 24-hours versus a rolling one month daily average. Values over 100 indicate volume higher than the average, values under 100 indicate volume lower than the average. Well, the pair in this case exceeds 200 levels which is the largest volumes among G7 currency segment.

We would foresee GBP on weaker side on the back of today's inflation report hearing and Brexit fears which would send the significant messages prior to MPC member's speech later in the day. We think the cconcerns over the possibility of a Brexit pummelled the pound on Monday and as a result of our earlier technical reasoning we could foresee pair to slip below 1.40 levels shortly.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute:

Go long 3M At the money delta Call, Go long 6M at the money delta put and simultaneously, Short 3M (1.5%) out of the money call with positive theta.

FxWirePro: GBP/USD delta risk reversals indicate mounting selling pressures - hedge via diagonal 3 way straddle versus call

Tuesday, February 23, 2016 8:31 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary