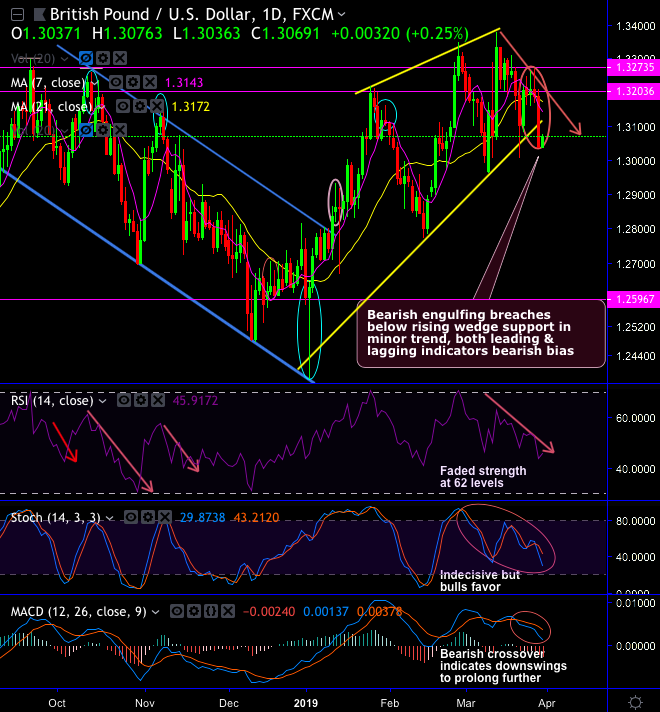

Technical chart and candlestick patterns: As we can observe technical chart of GBPUSD on daily terms, rising wedge pattern has been traced out in the interim uptrend. Bears manage to breach below wedge support upon the occurrences of shooting star and bearish engulfing pattern candles at 1.3187 and 1.3037 levels respectively.

While both leading and lagging indicators are in bearish favor, as both RSI & Stochastic curves show the downward convergence along with the price slumps to indicate the selling pressures.

For now, although cable’s current price sentiments are attempting to build on the rebound for the day from the lows of 1.3034 regions, the bullish sentiments in the minor trend are hampered, while trend indicators have also turned into bears’ favor. Bearish MACD and DMA crossovers indicate downswings to prolong further.

1.3203 - 1.33 levels is still perceived as the major barrier for further upward movement.

While 1.3006 region may act as strong support (crucial supports).

After the failure swings at wedge resistance, risking slumps below crucial supports can also drag up to 1.2927 levels.

On a broader perspective, we saw the resumption of the major downtrend after brief consolidation phase, slumps below EMAs are observed upon shooting star formation.

For now, the trend is on the verge of retracing 61.8% Fibonacci levels.

Overall, from the last couple of days, bulls have been attempting to hold onto the strong support at 1.2702 levels, but it is unwise to buck the major downtrend as we are yet to get better clarity from the technical indicators. Overall, the current price is trading at 1.3066 levels with severe weakness again.

Trade tips: Well, on trading perspective, at spot reference: 1.3066 levels, contemplating above explained technical rationale, it is advisable to trade barrier option strategy using tunnel strikes, upper strikes at 1.3105 and lower strikes at 1.3006 levels, the strategy is likely to fetch leveraged yields as long as underlying spot FX remains between these strikes on expiry duration.

Alternatively, on hedging grounds, shorting futures contracts of mid-month tenors were advocated, now we wish to uphold the same position as the underlying spot FX likely to slide southwards 1.28 levels in the medium-terms.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -134 levels (which is highly bearish), while hourly USD spot index was at 63 (bullish) while articulating (at 06:46 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex