In spite of GBP downtrend, election result doesn’t clear the way for a longer and smoother Brexit transition, at the time of writing the BBC projects the Conservatives will end up with 318 of 650- seats, 8 shy of a majority but enough to form a minority government, and 12 down on the total when Prime Minister May decided to call the vote. A political disaster for the Prime Minister and for the Conservatives, that leaves a weakened Government as they enter negotiations with the EU about the terms of leaving the EU.

From last month or so bears have been activated and is taking the pair to head towards retest the lows of mid-April (i.e. 135.595).

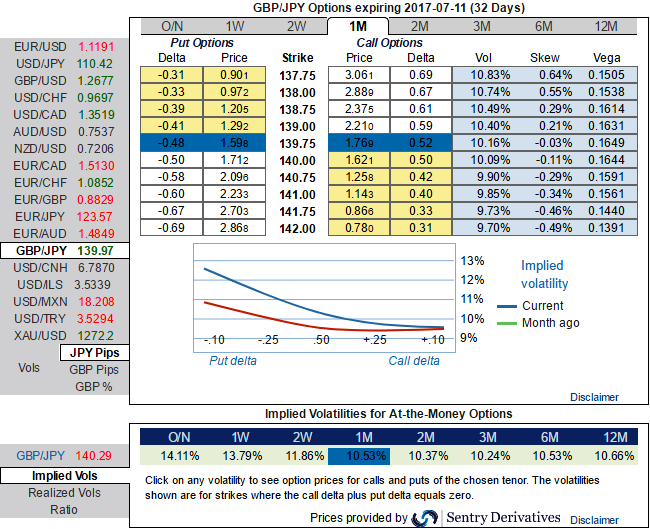

Please note that the nutshell showing the shift in delta risk reversals of GBP has been indicating downside risks in the weeks to come.

While higher IVs with positively skewed IVs signify the hedgers’ interest for OTM put strikes.

Mounting negative delta risk reversal can be interpreted as the opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Hence, we advocate weighing up above aspects in below option strategy, we eye on loading up with fresh vega longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility.

Further GBPJPY weakness and/or abrupt upswings suggest building a directional and volatility patterns at the same time: the value of OTM puts would likely to rise significantly as the IVs seem to be favoring these distant strikes. We, therefore, recommend shorting 2w IVs and buying IV skews of 2m tenors.

As a result, we believe in jacking up in long leg of the below option strategy:

Initiate longs of 2 lots of 2m at the money gamma put options, simultaneously, short 1 lot of (1%) out of the money put of 2w expiry with positive theta. It is advisable to prefer European style options.

We’ve chosen Gamma instruments on the long leg, because Gamma is the rate of change of the Delta with respect to the movement of the rate in the underlying spot FX market. In the Sensitivity table, Gamma shows how much the Delta will change if the underlying rate moves by 1%, thus the hedger would be in a position to ascertain how much of his FX exposure is effectively hedged.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data