- The Sterling remains on the defensive ahead of UK inflation data due later in the EU session.

- GBP/NZD is in the red for the fourth successive week, more downside on cards.

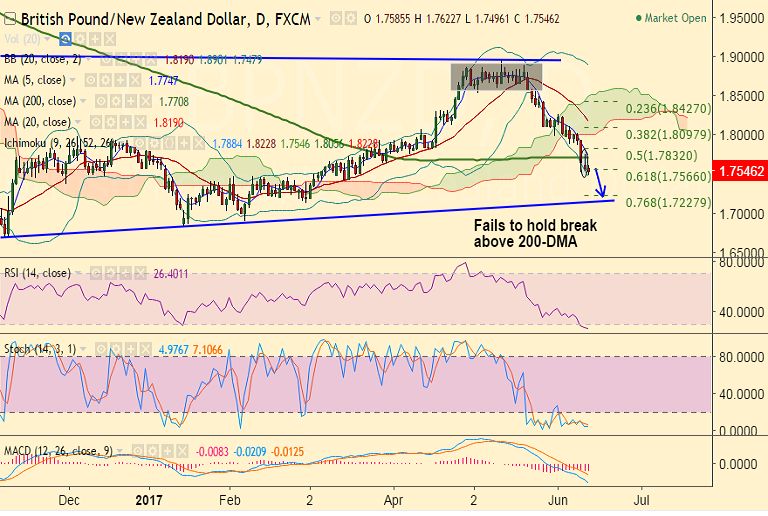

- Ichi cloud weighs on the upside on weekly charts, momentum studies biased lower.

- Selling pressure around the Pound has exacerbated following election results, we see scope for test of major trendline support at 1.7140.

- On the daily charts, the pair has failed to hold break above 200-DMA on Monday's trade.

- Upside remains capped below 5-DMA at 1.7747, we see bearish invalidation only on close above.

Support levels - 1.7433 (Mar 15, 16 low), 1.7187 (78.6% Fib), 1.7140 (Trendline & Mar 1 low)

Resistance levels - 1.7566 (61.8% Fib), 1.7708 (200-DMA), 1.7748 (5-DMA)

Recommendation: Good to go short on rallies around 1.7565/75, SL: 1.77, TP: 0.75/ 0.7440/ 1.72

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at -55.8704 (Neutral), while Hourly NZD Spot Index was at 56.5826 (Neutral) at 0640 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.