- UK services PMI beat forecasts at 53.6, bounced to 53.8 in July versus a 53.4 reading in the previous month.

- UK July composite PMI prints at 54.1 vs June 53.8, points to "steady but sluggish" +0.3 pct Q3 GDP growth.

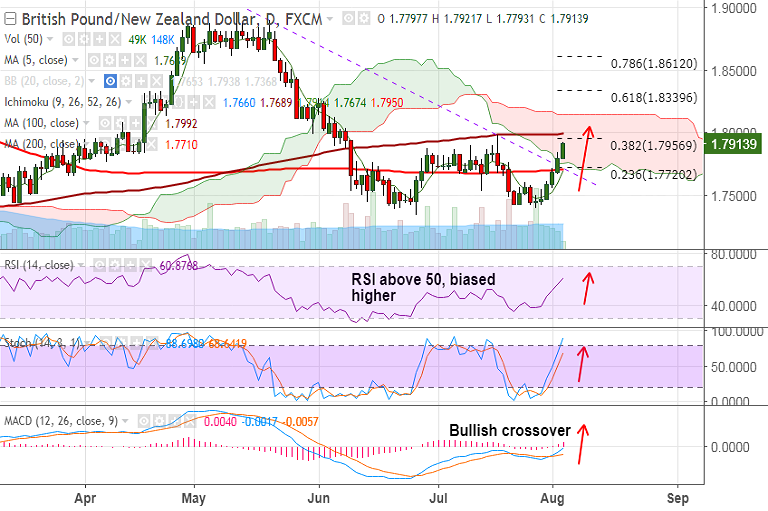

- Pound edged higher, GBP/NZD hit highs of 1.7921 before edging lower to currently trade at 1.7893 levels.

- Caution seen ahead of the BOE policy decision to be announced accompanied by the quarterly inflation report and meeting minutes.

- Analysts caution that investors should brace for hawkishness from the central bank.

- Technical indicators are bullish. RSI and Stochs are biased higher. MACD is now showing a bullish crossover on signal line.

- Upside finds stiff resistance at 1.7992 (100-DMA), break above could see extension of upside.

- On the flipside, break below 200-DMA at 1.7710 could see resumption of downside.

Support levels - 1.78, 1.7720 (23.6% Fib retrace of 1.8959 to 1.7337 fall), 1.7710 (200-DMA)

Resistance levels - 1.7956 (38.2% Fib), 1.7991 (100-DMA), 1.80

Recommendation: We prefer to remain on the sidelines into BoE policy meeting.

FxWirePro Currency Strength Index: FxWirePro's Hourly GBP Spot Index was at 148.848 (Bullish), while Hourly NZD Spot Index was at -73.9594 (Neutral) at 0940 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest