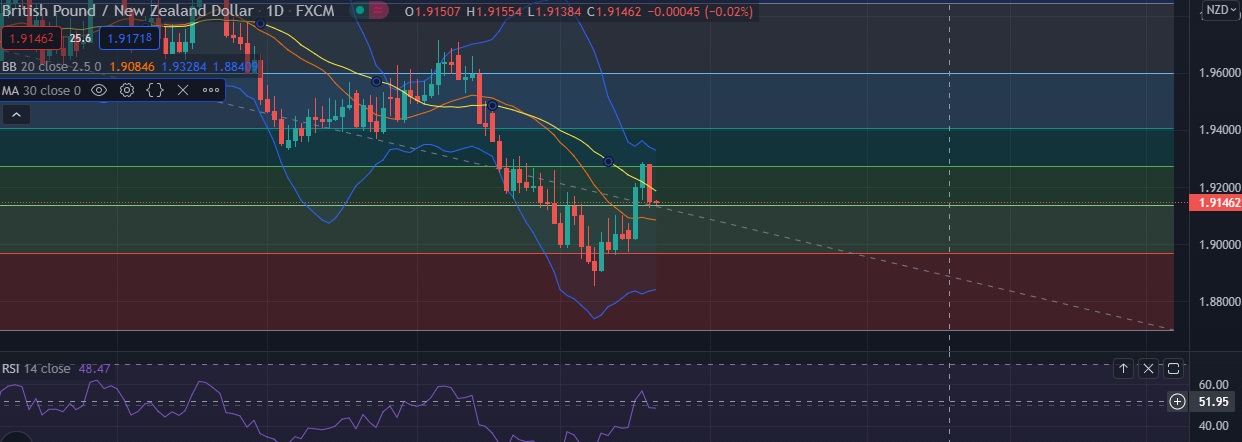

• GBP/NZD declined on Thursday as traders assessed whether recent gains linked to expectations of rate hike by BOE have gone too far.

•The pair is approaching 38.2% fib retracement at 1.9137, a daily close below which will accelerate towards 23.6 % fib.

• From a technical viewpoint, the moving averages 5,9 DMA’s are pointing downwards, while the RSI is bearish at 49.

• Immediate resistance is located at 1.9189( 30DMA), any close above will push the pair towards 1.9273 ( 50 % fib).

• Strong support is seen at 1.9137(38.2% fib ) and break below could take the pair towards 1.8965(23.6 % fib).

Recommendation: Good to sell around 1.9150, with stop loss of 1.9240 and target price of 1.9080.