GBP/JPY attempt to bounce back today after non-stop streaks of slumps but we reckon upswings are just as deceptive rallies.

Brexit polls have been notoriously volatile. Before last week, the stay camp appeared to have gained traction. In a dramatic turnaround since May, some 53% now want to leave and 47% want to stay, the majority of Brits now want to leave from EU group.

GBP did not go quietly. Most stock markets fell and investors sought safety in bonds. Unlike JPY and CHF, EUR did not become a safe-haven currency on a belief that Brexit would lead to negative spillover into the Eurozone, so sterling including euro would be in deep trouble ahead of mounting sentiments of Brexit outcome rather than Bremain from the UK referendum.

As risk aversion returned, WTI crude oil prices abandoned its hope of pushing above $50/barrel and retreated to $49.07.

We kept stating and now reiterate “capitalize on interim GBP/JPY rallies to deploy shorts in PRBS for hedging on this risky event”.

Technical Watch:

On monthly plotting, the downtrend has already shown more than 50% Fibonacci retracements and currently broken major supports at 156.092 (it was holding from last 4 to 4 and half months), so any minor spikes should not be deemed as reversals, instead use those rallies to deploy long term shorts. Leading oscillators (RSI & stochastic) have been convincingly converging to the major downtrend.

GBP/JPY OTC FX Observation:

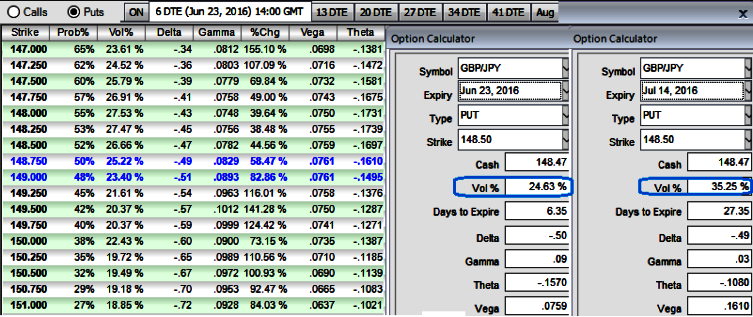

Please have a glance on implied volatilities of ATM puts, the IVs of this pair of 1w expiry is at 24.63%.

2W to 1M expiries are acting crazily in OTC markets, 46.82% and 35.25% respectively.

Gamma on OTM strikes moving with a rapid speed, but %change in option price is ticking negative figures as the pair evidencing upswings for the day. You can also observe IVs of 1W expiries have reduced a bit, thus, this could be interpreted as the right time and right opportunity to deploy shorts in Put Ratio Back Spreads used as a hedging strategy.

What is weighing on the pound's slumps is that all major central banks including BoE maintained their “Status Quo” in their monetary policy review amid lingering Brexit probabilities that add an extra pressure on sterling's depreciation. But IVs of 2 months tenor will pick up gradually during Brexit announcements.

Hedging Strategy:

So, on hedging grounds initiate longs on 2 lots of 1M At-The-Money -0.49 delta puts that would function effectively in considerably higher IV times (see sensitivity table for higher probabilities and stabilized Vega growth). Simultaneously, deploy shorts side of 1 lot of 1w (0.5%) ITM put option. The net delta should be around 43% and the positions could be entered with reduced debit.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data