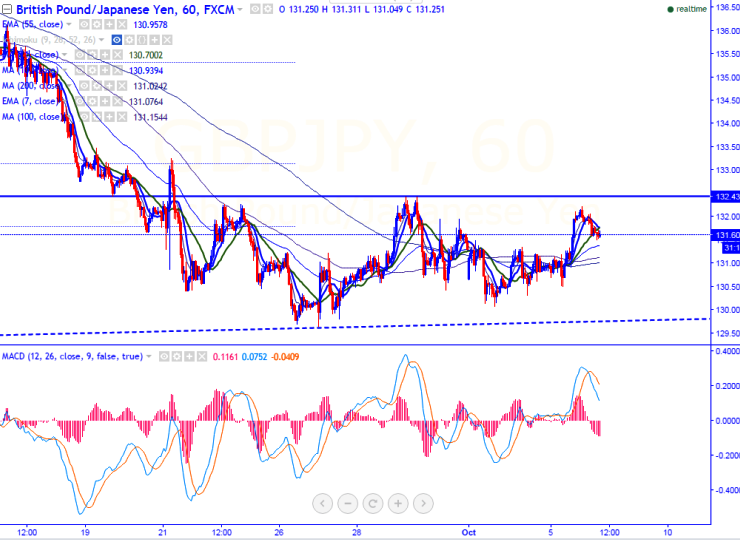

- Major resistance- 132.45 (Sep 29th high).

- Major support – 129.80 (trend line joining 129.06 and 129.62).

- GBP/JPY has pared its gains from its high of 132.23made yesterday. It is currently trading around 131.63.

- The pair is facing major resistance at 132.45 and any slight bullishness only above that level.

- In the hourly chart, the pair is trading slightly above Kijun-Sen (131.36) and it should break above temporary top at 132.45 for further bullishness. Any break above 132.45 will take the pair to next level till 133.26/134.25 in the short term.

- On the lower side, any break below 129.80 confirms minor weakness, decline till 129.06/128 is possible. The minor support is around 131 (200- HMA).

It is good to sell on rallies around 131.85-131.90 with SL around 132.50 for the TP of 130.30/129.80.