GDP, PMIs, and monetary policies in both continents (Data schedules):

In the UK: Manufacturing PMIs on March 1st, Construction PMIs on March 2nd and Service PMIs on March 3rd, annual budget release on March 8th, BoE’s monetary policy on March 16th.

In Japan: Final GDP QoQ and current account balance on March 7th, BoJ’s monetary policy on March 15th.

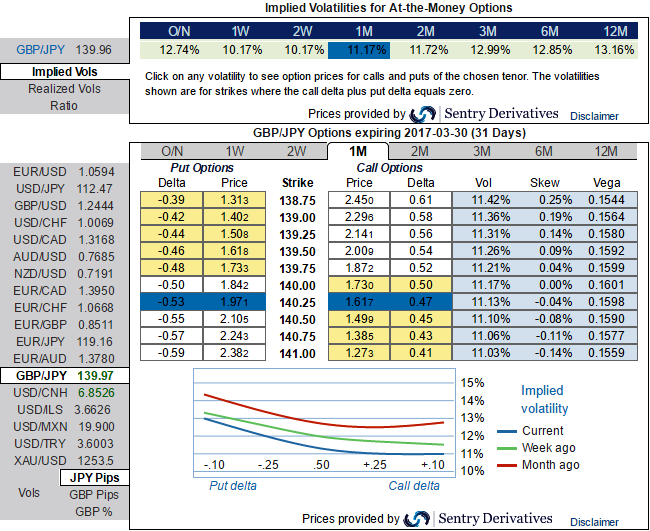

OTC updates: Please be noted that the 1m implied volatilities are spiking above 11.21% ahead of above-mentioned data events, while positively skewed IVs signifies the hedging interests in OTM put strikes.

In spite of GBPJPY downtrend seems to be intact, a lot of bad news is already priced in and digested by the market. Brexit caused two Sterling debacles, first in June with the vote and then after the summer when PM May suggested a hard exit.

GBPJPY lost over 5% over this quarter with one more month to spare and it doesn’t seem the dust has settled. In the process, volatility fell but remained relatively high on a historical basis.

Assuming a medium-term range in cable and that negative surprises are no longer market tail risks, the GBP volatility is still short.

Even if the aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility.

But further GBPJPY weakness and/or abrupt upswings suggests building a directional and volatility patterns at the same time: the value of OTM puts would unlikely to rise significantly as the IVs do not seem to be favoring these distant strikes. We, therefore, recommend buying a 1m2w IV skews and risk reversal with ATM options.

Hedging Recommendation:

In order to match above IV skewness for 1m2w tenors, we advocate initiating longs in 2 lots of 1m ATM -0.49 delta puts, while long in 1 lot of +0.51 delta call of 2w tenor, please be noted that the payoff function of the strategy likely to derive positive cashflows regardless of swings but more potential from 2 puts are more than 1 call.

The risk is limited to the extent of the price paid to buy the options.

The reward is unlimited till the expiry of the option.

Please note that the trader can still make money even if his anticipation goes wrong – but the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty