The somewhat panicky unwinding of Euro (and other European FX) longs might leave macro investors less willing to spend option premium to play for EUR resurgence. In this situation, if one had to pick one Eurobloc currency to buy vol in, our preferred pick would be GBP, especially on the crosses.

While we continue to reckon that the abrupt shift in BoE policy and the attendant possibility of a policy mistake make sterling a fundamentally more uncertain currency than many others. The range of spot outcomes on cable has now opened up from a previously narrow 1.28-1.30 band to a much wider 1.28 -1.36 (or higher) which ought to command a higher premium in implied vols than before.

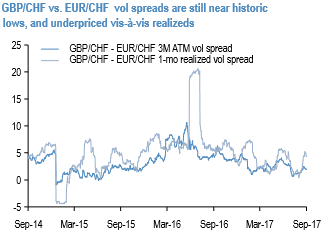

Yet GBP implied vols have retraced 3/4ths of the ramp up from earlier this month and recent realized vols are clocking 1 vol above short dated implieds, hence this appears to be a case of underpriced fundamental uncertainty with supportive technical for gamma ownership. GBPCHF (GBP vs. CHF implied correlation 40%, realized corrs 35%) in particular strikes as a useful long within the GBP-cross complex, we prefer financing it via shorts in EURCHF.

GBPCHF, CHFJPY, and AUDCHF, CHFJPY dual digitals as low premium risk hedges: An eye-catching artifact of the ramp-up in CHF vols is that CHF-denominated (i.e. CHF/X vs. CHF/Y) correlations are now the most overpriced in G10.

Since most CHF-crosses are pro-cyclical in nature, decoupling plays require an anti-cyclical counterpart; USDCHF (typically higher in equity market stress) and CHFJPY (lower) are the only two candidates that fit the bill.

Of these, the utility of USDCHF as an anti-risk play is questionable at a time when European cyclical strength is powering EURUSD higher, which leaves CHFJPY as the only available option.

The GBPCHF – EURCHF vol spread has picked up from 15-yr lows but is still stuck near the bottom-end of a long-term range, the vol spread has a desirable tendency for one-sided eruptions in favor of a wider GBPCHF premium during market crashes, and enjoys a healthy positive carry at inception (2M ATM vol spread 1.9 mid, realized vol spread 4.0 on 1-wk and 4-wk lookbacks using hourly spot data; refer above chart).

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different