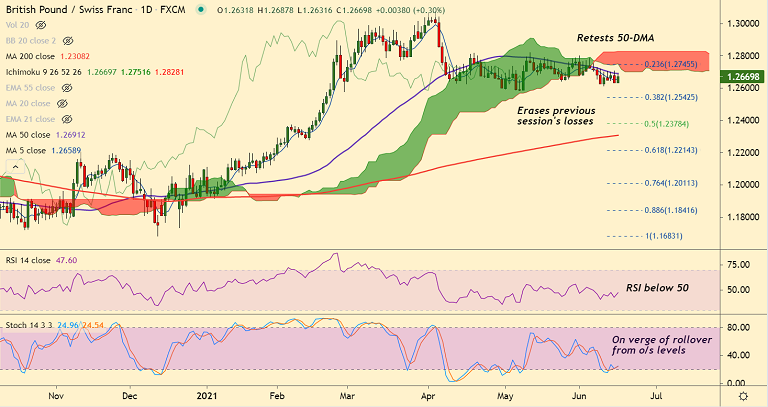

GBP/CHF chart - Trading View

GBP/CHF was trading 0.29% higher on the day at 1.2668 at around 08:30 GMT.

The British pound was buoyed after strong UK CPI stoked chances of a BOE rate hike.

Data released earlier today showed UK Consumer Prices Index (CPI) 12-month rate came in at +2.1% in May, beating estimates at +1.8% and compared to +1.5% in April.

Meanwhile, the core CPI rose by 2.0% YoY last month versus +1.5% registered in April, matching the consensus forecast of +1.5%.

The monthly figures showed that the UK consumer prices arrived at +0.6% in May vs. +0.3% expectations and +0.6% prior.

GBP/CHF erased most of the previous session's losses and is testing 50-DMA resistance at 1.2691. Decisive break above will buoy bulls.

Major trend in the pair is neutral. Break above cloud will change near-term dynamics. Rejection at 50-DMA will negate any upside bias.