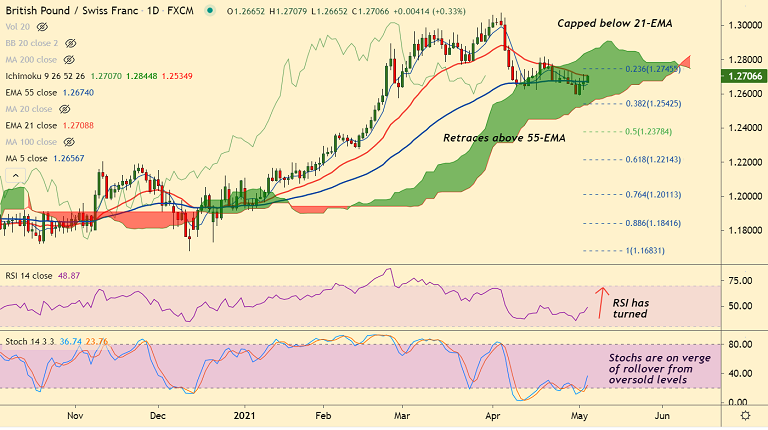

GBP/CHF chart - Trading View

GBP/CHF was trading 0.29% higher on the day at 1.2700 at around 06:30 GMT, after closing largely unchanged in the previous session.

The pair has ignored a spinning top formation on the previous day's candle and is extending gains for the 3rd straight session.

Technical indicators are turning bullish. RSI is now biased higher and Stochs are on verge of rollover from oversold levels.

The pair has retraced above 55-EMA and is now testing 21-EMA resistance at 1.27 mark. Decisive break above will fuel further gains.

Chaos around Brexit continues to threaten the performance of sterling. In recent developments, the Northern Ireland Agriculture Minister warned of legal action over post-Brexit trading arrangements.

As for fresh trade impetus, focus remains on the releases of the UK Final Services PMI. Upbeat data could add to the upside bias.

Bulls target cloud top at 1.2844. 55-EMA is now strong support at 1.2674. Bullish invalidation only below 200W MA.