Chart - Courtesy Trading View

The British pound gained traction overnight as a reaction to upbeat UK employment data, pushing the pair higher.

UK inflation data for April month is due early on Wednesday at 06:00 GMT. UK headline CPI is expected to rise to 9.1% YoY figure versus 7.0% prior. The monthly CPI reading is likely to increase to 2.6% versus 1.1% prior.

While the Core CPI, which excludes volatile food and energy items, is likely to rise to 6.2% YoY, from 5.7% previous readouts.

Given the recently strong employment data released on Tuesday, coupled with the increased odds of the Bank of England’s (BOE) faster rate hike trajectory, today’s data will be crucial.

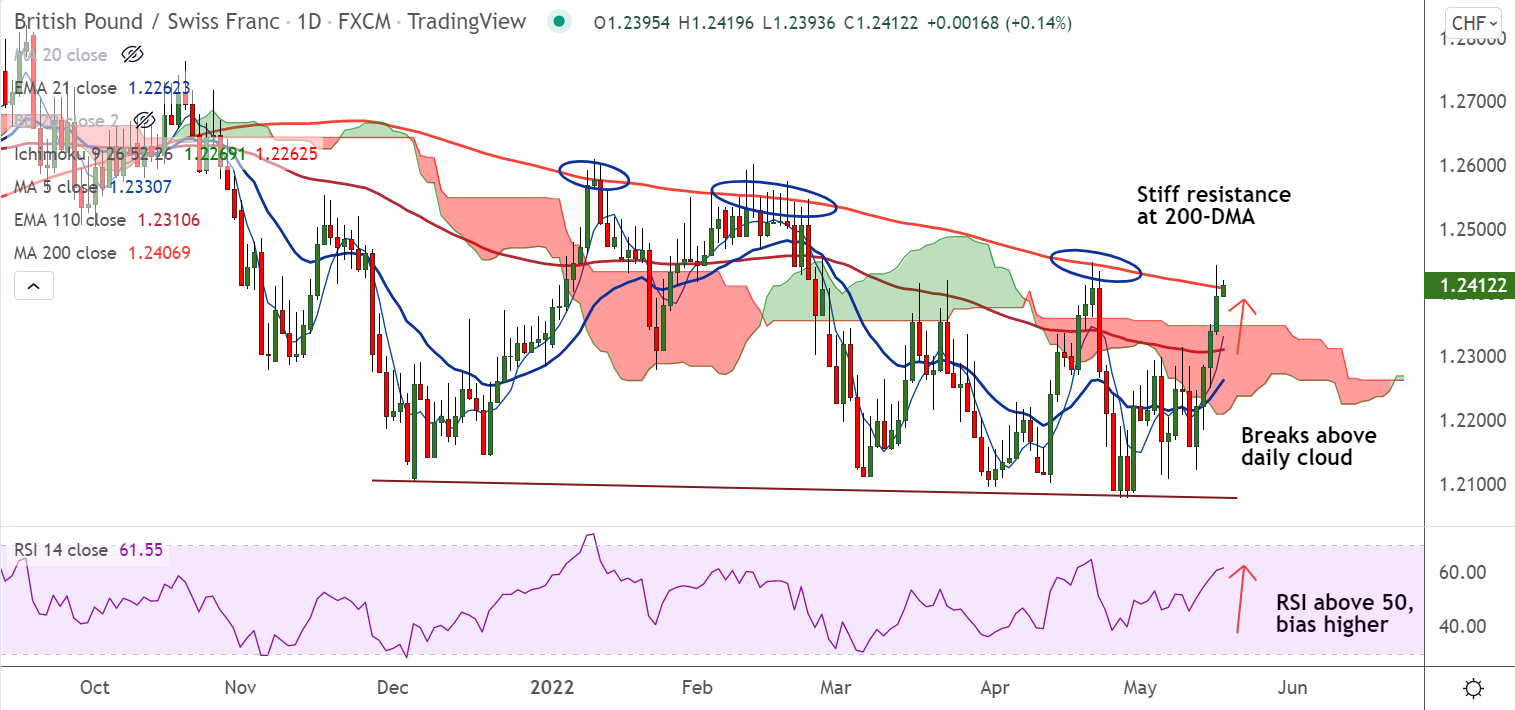

GBP/CHF surged past 200-DMA, but failed to hold gains, closed lower overnight and is currently hovering around the same levels.

The pair has faltered at 200-DMA on several occasions and decisive break above is required for further gains.