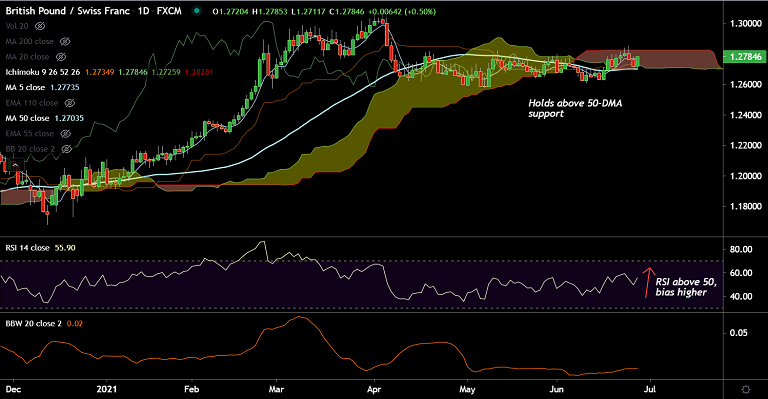

GBP/CHF chart - Trading View

GBP/CHF was trading 0.46% higher on the day at 1.2779 at around 07:45 GMT.

The pair snapped a two-day downtrend induced by the Bank of England’s (BOE) dovish surprise and a rapid rise of Delta plus covid variant in the UK.

The British pound remained bid amid UK reopening and Brexit optimism, pushing the pair higher.

Technical bias for the pair is neutral. Price action has ignored a Gravestone doji formation in the previous week.

Price action is consolidating above 200-week MA. On the intraday charts, the pair has edged above 200H MA resistance and is holding above 5-DMA.

Price action has bounced off 50-DMA which is strong support at 1.2703, decisive break above daily cloud will fuel further upside.

On the flipside, 50-DMA is strong support at 1.2703. Breach below will see dip till 110-EMA at 1.2611.