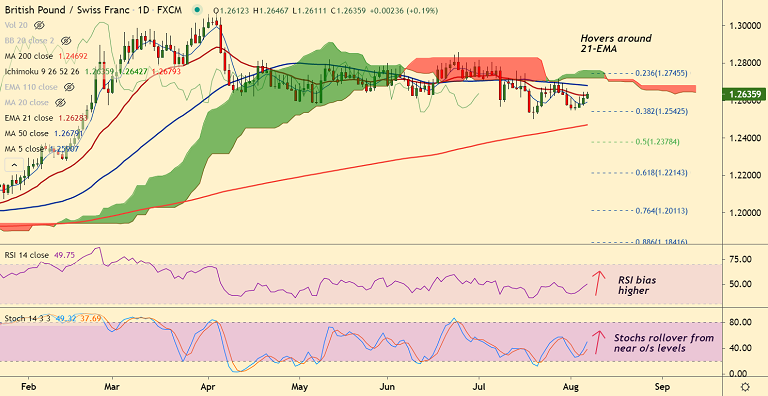

GBP/CHF chart - Trading View

GBP/CHF was trading 0.18% higher on the day at 1.2635 at around 10:00 GMT, after closing 0.24% higher in the previous session.

The pair witnessed some follow-through buying for the fourth consecutive session on Friday after BoE's modest tightening hint.

The central bank on Wednesday indicated that it would begin reducing its quantitative easing when the benchmark rate hits 0.5% as compared to the previous guidance of 1.5%.

The change suggested that the unwinding of the balance sheet could come more quickly than previously anticipated.

The BoE also upgraded UK's near-term GDP growth and inflation forecasts, another positive factor that underpinned the GBP.

GBP/CHF is grinding sideways since April. Upside remains capped below the daily cloud and decisive break above required for upside continuation.

No major signs of reversal seen. Price action hovers around 21-EMA. Continued bullish momentum could see test of 55-EMA at 1.2661 ahead of 50-DMA at 1.2679.