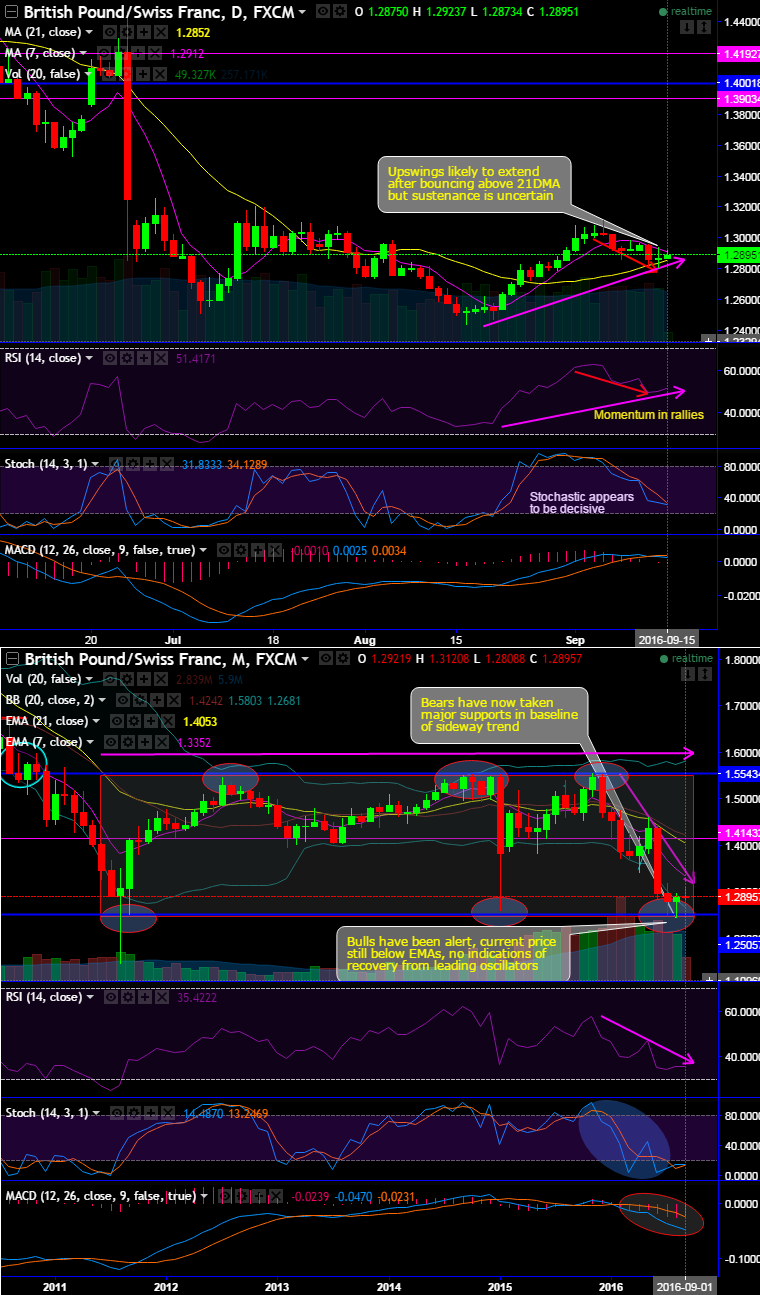

Last one week’s price declines are no halted at 21-DMAs (at 1.2852 levels).

On the flipside, from last two days, the bulls of this pair seem to have snapped the gains at 7-DMA, we foresee more gains given break out above resistance at 1.2912 levels (7-DMA).

Amid bull and bear swings, the current prices have remained between DMA curves on daily charts, but for now, intraday swings seems to be extending gains.

RSI converges to the rising prices both on daily graphs, while stochastic curves puzzle with indecisiveness.

On monthly plotting, the ongoing downtrend is extremely robust that signalled particularly by both leading and lagging indicators.

Selling sentiment is likely to prolong by moving average and MACD lagging indicators as 21DMA crosses over 7DMA, while MACD’s bearish crossover slide below zero levels.

This bearish environment is substantiated by leading oscillators as well.

While, the stochastic oscillator has reached oversold territory but no signals of bullish momentum. RSI on this timeframe evidences downward convergence to the dipping prices below 44 levels.

For now, the pair has taken a major supports in the baseline of the sideway trend, we think the decisive breach below 1.2505 levels would set a new bearish trend.

Overall, GBPCHF for the day should be little bullish bias, else remain in a choppy range now but certainly not a shorting option for now.

Trade setup:

On intraday terms, the trade strategy would be the boundary binary options by using cash-or-nothing options for targets around 40-50 pips.

At spot reference: 1.2890, Upper strikes – 1.2941; lower strikes around 40 pips below from the current levels i.e. 1.2851 levels (21-DMA).

The trading between these strikes likely to derive certain yields in this puzzling trend and more importantly these yields are exponential from spot FX.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 1.2851 > Fwd price > 1.2941).