BoE's Governor Carney has also made optimistic comments similarly to Yellen, of rates starting their slow normalization process around the turn of the year. This brings anything from November to February into focus, and has given the GBP another wave of buying support.

Technicals (GBP/CHF):

EOD and weekly technicals raises a caution for ongoing uptrend as prices do not evidence corresponding volumes and there was a sense of divergence evidenced on RSI curve to the rising prices. Both daily and weekly stochastic oscillator signals overbought situation as %D line crossover occurred above 80 levels which is overbought territory.

GBPUSD should remain in a choppy range now, with GBP outperforming in the crosses. EURGBP is expected to broadly remain under pressure with technical support at .6940/30 ahead of .6850/30. Resistance lies at .7040/50 and then .7125/35.

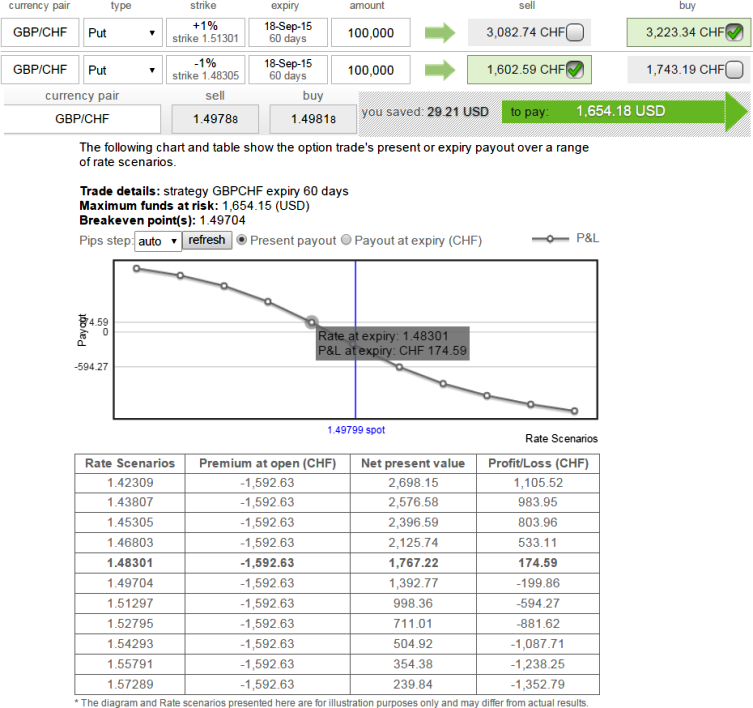

So, our recommendation would be buying 2M (1%) In-The-Money -0.63 delta puts and simultaneously writing an equal number of near-month (-1%) Out-Of-The-Money puts. The delta of combined position should be at around -0.22.

As shown in the diagrammatic representation, one can make out how the option payoff at expiry increases as the exchange rate diminishes.

This strategy is typically employed when the options trader is bearish on the underlying exchange rate over the longer term but is neutral to mildly bearish in the near term.

As there is intraday buying trend is on with positive technical indications, we see buying opportunities in binary calls for a targets of 15-20 pips.

FxWirePro: GBP/CHF attempts to hold resistance at 1.5005, prefer diagonal debit put spreads to hedge, binary calls to speculate

Monday, July 20, 2015 11:08 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand