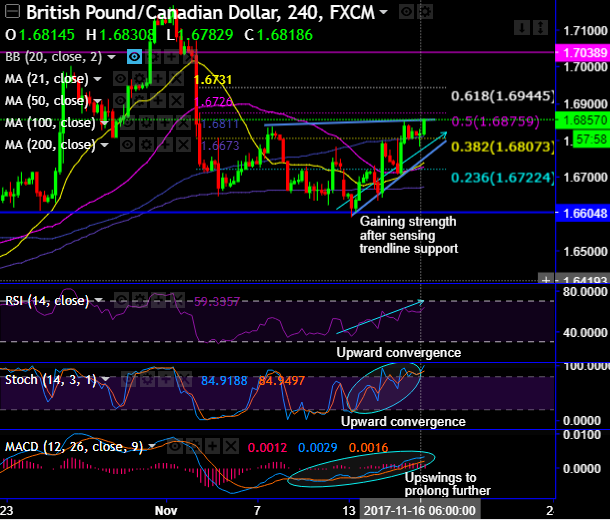

GBPCAD has formed a temporary top around 1.71653 and shown a huge decline from that level. The pair dipped till 1.65894 and is currently trading around 1.6835.

The near-term resistance is around 1.68520 (trend line joining 1.6835 and 1.68510) and any break above confirms minor bullishness a jump till 1.6900/1.6940 (61.8% retracement of 1.71653 and 1.65894)/1.6985 (161.8% retracement of 1.6835 and 1.65894).

While subdued retail sales growth in July reflected an ongoing deterioration in household finances, Retail sales rose 0.3% in July, according to the Office for National Statistics, identical to the rise seen in June. However, this is a relatively lackluster start to the third quarter which suggests sales are on a weakening trend.

In the 4H chart, the pair is trading above short-term (50 and 20DMA) and long-term MA (100 and 200DMA).

On the lower side, near-term support is around 1.6750 (55- 4H EMA) and any violation below will drag the pair to next level till 1.6672 (233- 4H MA)/1.65894. Minor weakness below 1.6585 (Nov 13th, 2017 low).

It is good to buy above 1.68520 in cash with SL around 1.6800 for the TP of 1.6940/1.6985, while speculators bid for one-touch binary call options for leveraged yields.