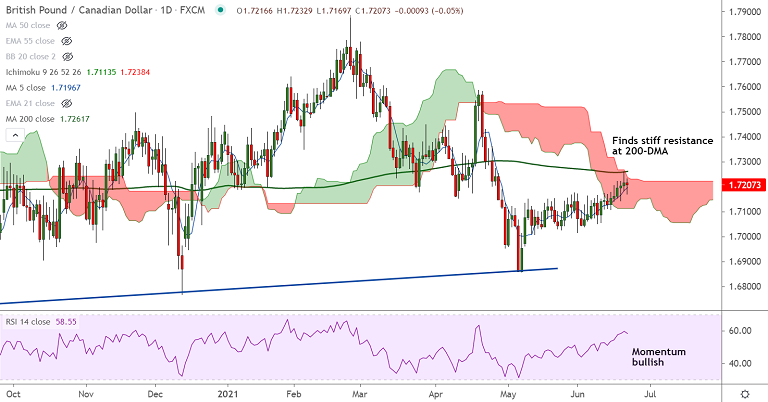

GBP/CAD chart - Trading View

Technical Analysis: Bias Bullish

- GBP/CAD was trading largely unchanged at 1.7215 at around 13:25 GMT

- The pair has paused upside at 200-DMA which is offering stiff resistance at 1.7261

- Price action is holding above 200H MA which is supporting pullbacks in the pair

- Momentum studies are bullish and volatility is rising as evidenced by widening Bollinger bands

- Decisive break above 200-DMA and daily cloud will propel the pair higher

Support levels - 1.7198 (5-DMA), 1.7173 (55-EMA), 1.7146 (21-EMA)

Resistance levels - 1.7226 (110-EMA), 1.7261 (200-DMA), 1.7293 (20-month MA)

Summary: GBP/CAD has paused upside at 200-DMA. Technical studies support upside. Decisive break above 200-DMA will propel the pair higher.