Dear readers, let's begin with this hedging formulation after a brief glance over our previous post on the trend analysis of this pair.

Technically, bull swings taking support at 50% fibo retracements form bullish candle with big real body on monthly terms, previous intermediate downtrend seems to have reversed but volumes yet to confirm.

So, we would like you to understand the mystification of these puzzling swings revolving in this pair.

Currently, it looks like signs of the uptrend are back again, which in turn these price gains could be deemed as recovery swings.

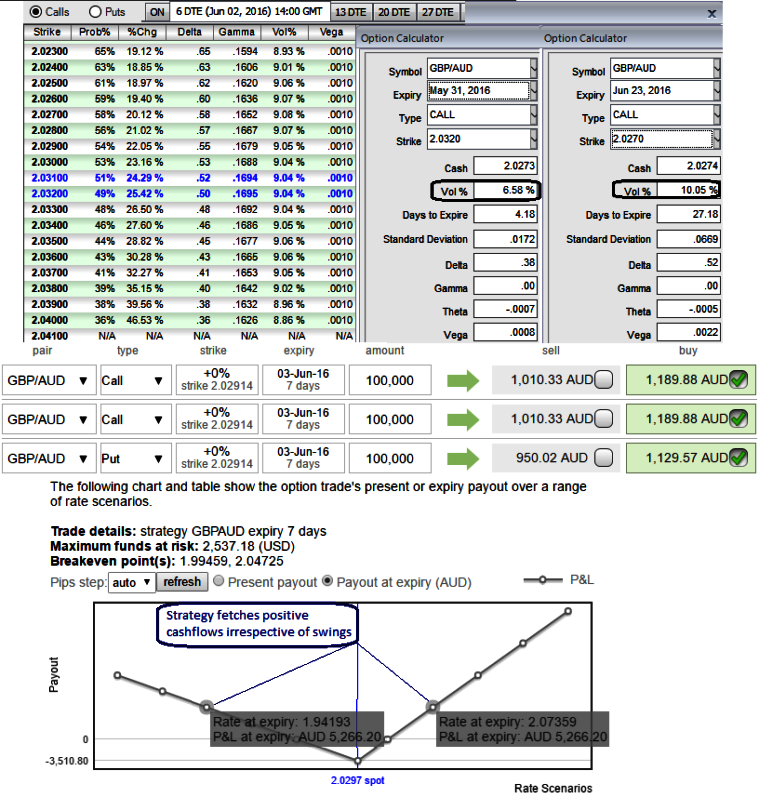

In sensitivity table, the delta is progressively growing along with gamma numbers as this Option Greek is an indicators of rate of change in delta.

So these numbers are steady even if you shift 1% on either side of the spot, the steadiness is also indicated by constant rise in IVs and vega.

Hedging Perspectives: Option straps (GBPAUD)

Subsequently, those who wants deploy this strategy in the hedging mindset, the risks of FX portfolios from ongoing bullish trend and any abrupt slumps could be mitigated through these positions in the strategy, and can concentrate in their core business areas.

We recommend building portfolio with longs positions in 2 lots of 0.50 delta ATM calls with 1M expiry and 1 lot of -0.49 delta ATM puts of 2w expiries. (For demonstrated purpose only we’ve used identical expiries in the diagram).

Hence, this GBPAUD option strips strategy should take care of ongoing upswings and abrupt downswings and yields handsome returns.

One can observe in the diagram rising delta effects upon rising exchange rate GBPAUD and shrinking as the underlying spot rate dips which means our underlying outrights are fairly hedged against irrespective of rate scenarios.

Delta of far OTM options is very small which is why we’ve chosen ATM instrument on call. 1-point movement in underlying pair will not have much effect on the option premium.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand