As stated in our earlier post on this pair’s technical lines, bears have extended slumps below 61.8% Fibonacci retracements and major downtrend still seems bearish despite abrupt upswings.

We continue to maintain our bearish stances as the on-going downtrend to prevail further.

As the pair has recently tested support at falling wedge baseline at 1.6757 levels, some abrupt upswings could be expected amid a robust downtrend. Well, we do not want to miss these swings with a view of profit maximization objective.

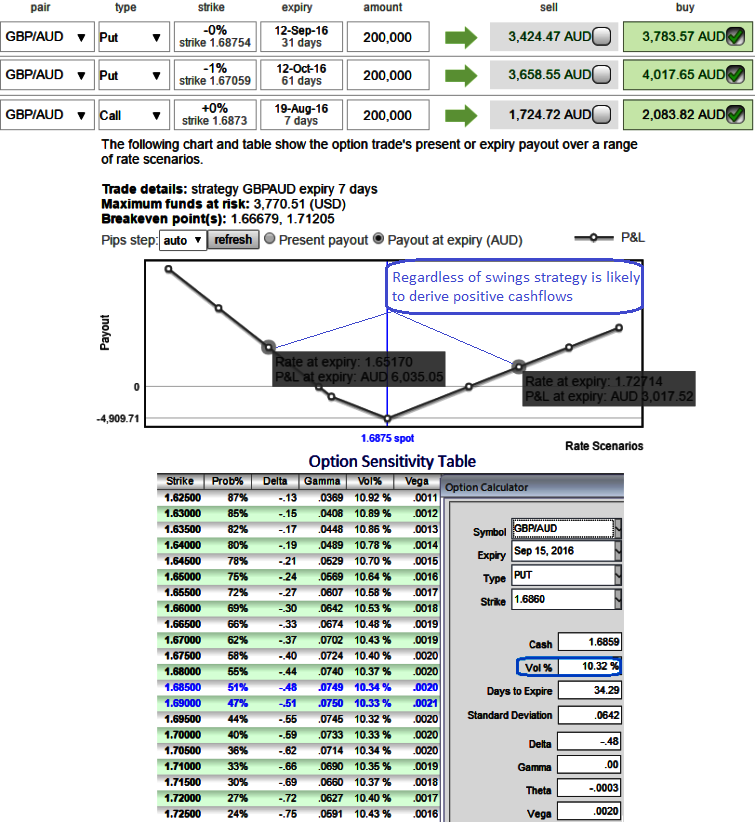

Thus, at spot ref: 1.7425 levels, as shown in the diagram the strategy could be deployed with 2 lots of longs in 1M at the money -0.49 delta puts and one can always ask – why not buy cheaper options of both the call side and the put side. Well yes you will save money but the risk will also increase, 2M (1%) out of the money -0.38 delta put option is also preferred, simultaneously, initiate longs in 1 lot of 1W at the money +0.51 delta call option at net debit.

These positions would effectively function to tackle both short term upswings and long term downswings in higher IV times as we’ve chosen narrow expiries, also be noted that vols and vega on either side (both ITM and OTM strikes) are almost moving in similar pace.

Risk/reward profile: See that profits from 2 puts are more than 1 call. The risk is limited to the extent of premium paid to buy the options if the underlying spot doesn’t show significant moves on any side. Returns are unlimited until the expiry of the option.

Please note that the trader can still make money even if the prediction goes wrong – but the underlying spot has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts