• GBP/ AUD strengthened on Friday as weaker Australian dollar and expectation Bank of England will further hike interest boosted the pair.

• Newfound UK political stability, elevated BoE rate expectations to counteract rising UK inflation has given bulls momentum for further gains.

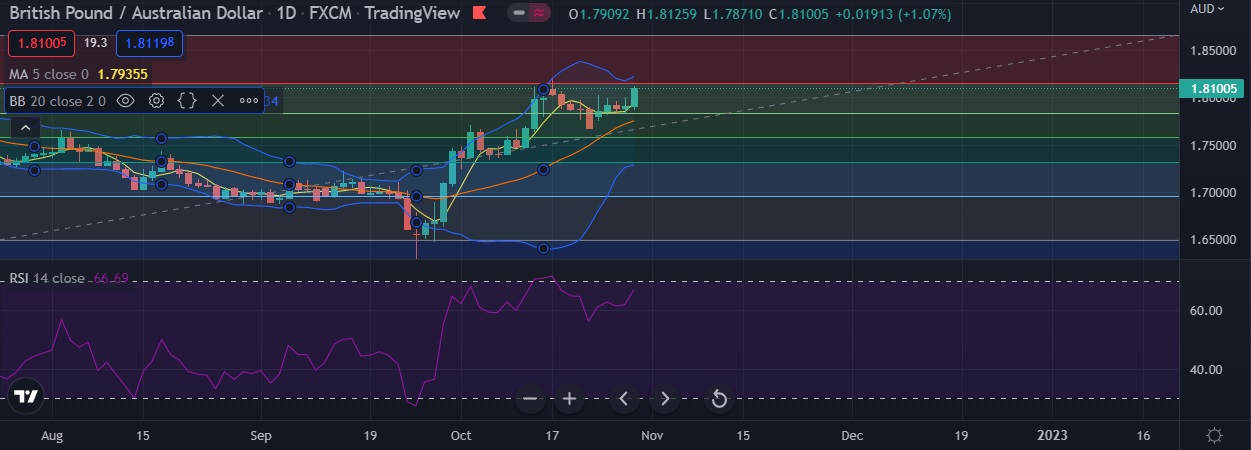

• Technical signals show the pair could gain more ground in the short-term as RSI is at 66,while moving averages and MACD are trending higher.

• Immediate resistance is located at 1.8140 ( 38.2%fib), any close above will push the pair towards 1.8495(Higher BB).

• Immediate support is seen at 1.7935 (5DMA) and break below could take the pair towards 1.7849 (38.2%fib).

Recommendation: Good to buy around 1.8090, with stop loss of 1.8000 and target price of 1.8170