GBPAUD rallies have gone above SMAs on weekly plotting but remained well below the sloping trend line, for now, upside potential is seen only upto trendline.

As you could see, the upswings have gone in the narrow range from last two-three weeks, any rejection below trendline likely to evidence slumps again; a break above may drag rallies upto 1.7769.

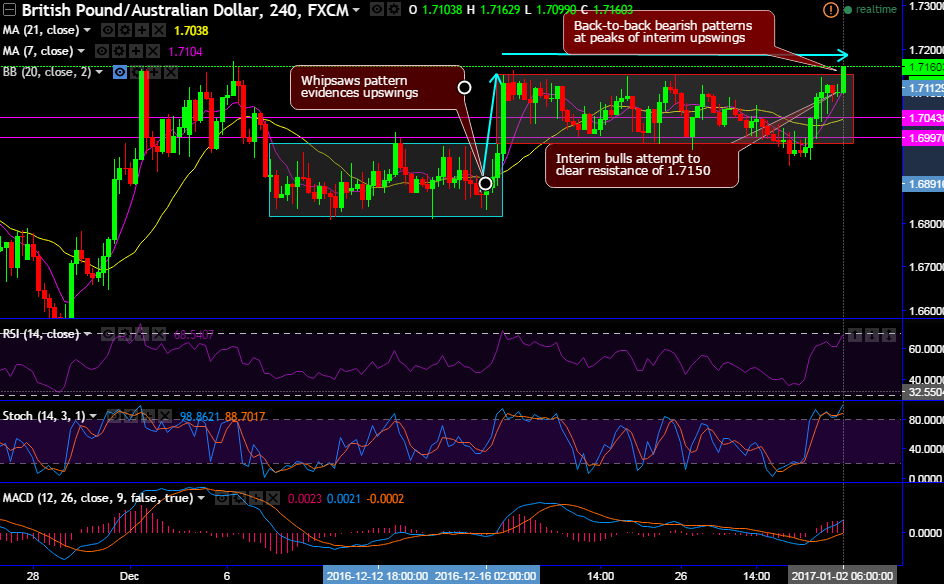

Back-to-back bearish patterns (like spinning top, hanging man and doji on 4H charts) at peaks of interim upswings, prior to this, Whipsaws pattern evidences upswings. For now, Interim bulls attempt to clear resistance of 1.7150.

While both leading (RSI and stochastic) indicators are suggestive mild bullish momentum.

The stochastic oscillator has reached overbought region and still been popping up with buying pressures on both weekly and monthly plotting, the attempts of %K crossover are also convincing of bull swings while RSI is slightly bears’ favor.

At this juncture, we see speculative opportunities in double touch binary options, this option trade is useful for intraday traders who believe the price of an underlying spot FX would undergo a large price movement, but who are unsure of the direction.

At spot ref: 1.7160, a trader can use a double touch option with barriers at 1.7184 and 1.7144, thereby, 40 pips are reasonable to speculate this pair on either side.

Some traders view this type of exotic option as being like a straddle position since the trader stands to benefit on a calculated price movement up or down in both scenarios.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary