• GBP/AUD Initially gained on Wednesday but gave up ground as soaring energy prices and a surge in bond yields hit the pound.

• The prospect of imminent rate hikes, signalled by the Bank of England, was not enough to support gains for pound on Wednesday.

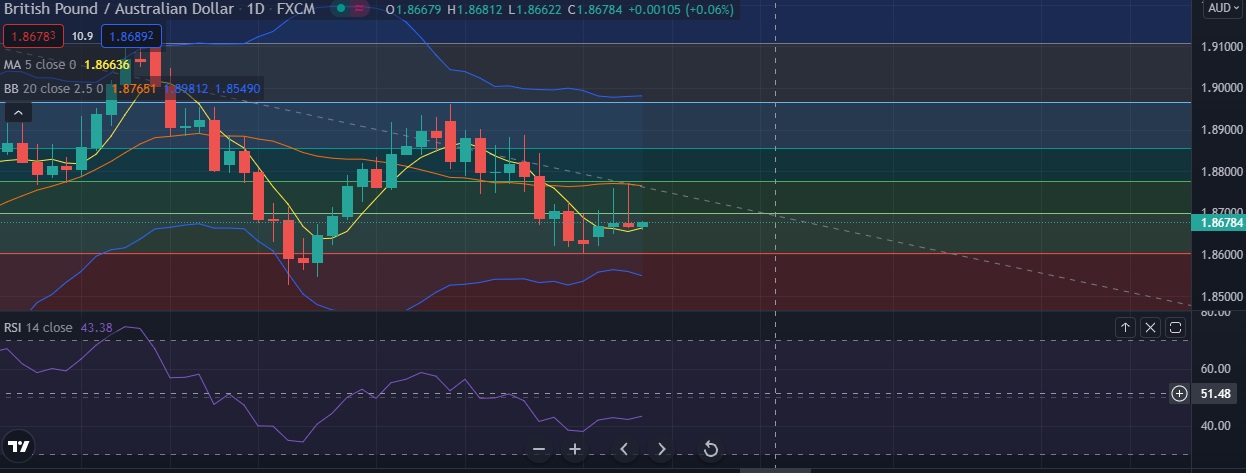

• At GMT 21:32, the pair was trading 0.18% higher at 1.8678 after hitting daily high at 1.8771.

• Technical are bearish, daily RSI is negative at 44, daily momentum studies 9 and 10 DMAs are trending down.

• Immediate resistance is located at 1.8699 (38.2%fib ), any close above will push the pair towards 1.8774 (50% fib).

• Immediate support is seen at 1.8661 (5DMA) and break below could take the pair towards 1.8603 (23.6%fib).

Recommendation: Good to sell on around 1.8690, with stop loss of 1.8770 and target price of 1.8600