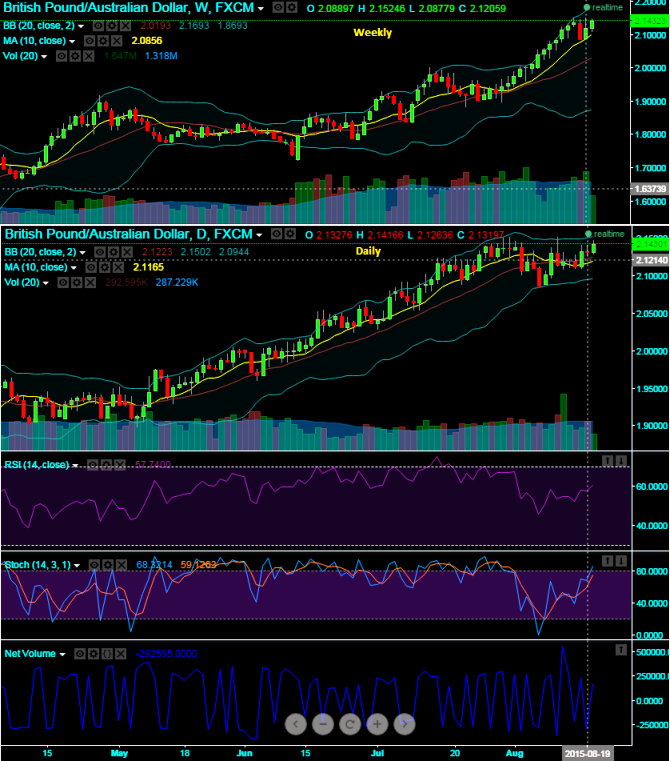

We believe GBPAUD uptrend has been quite healthy as the upswings are moving with considerable corrections at the right time, it has neither been steep spikes nor steep declines and you can make out from daily charts as the oscillating indicators are also positively converging with price spikes. Current 10 day moving average is evidencing long term uptrend remains intact.

Speculate with credit call spreads:

On speculation grounds, (1%) out of the money 0.48 delta call options, simultaneously sell (-1%) in the money call, use lengthier expiry on longs and shorter expiry on short side.

This spread strategy is to be employed because we think that the price of GBPAUD should consolidate moderately in the near term, as we anticipated a short term downswings the premiums collected on In-The-Money calls can be pocketed in.

Hedge Perspectives: Call backspreads

Since moderately bullish trend is anticipated in medium term so we had set a target price earlier for this bull run to go beyond 2.1575 levels and utilize bull spreads to reduce risk. While maximum profit is capped for these strategies, they usually cost less to employ.

Buy 2M (2%) 2 lots of out of the money 0.35 delta calls, on expiry that would discount everything high impact news scheduled in September month while shorting 15D (-1.85%) in the money calls. We maintain these (ITM & OTM) levels in our strategy by keeping global macroeconomic aspects such as Fed's rate hike and BoE's speculation that may have adverse impact on this pair.

FxWirePro: GBP/AUD credit call spreads for swing trade and call backspreads for hedging on healthy uptrend

Thursday, August 20, 2015 11:56 AM UTC

Editor's Picks

- Market Data

Most Popular