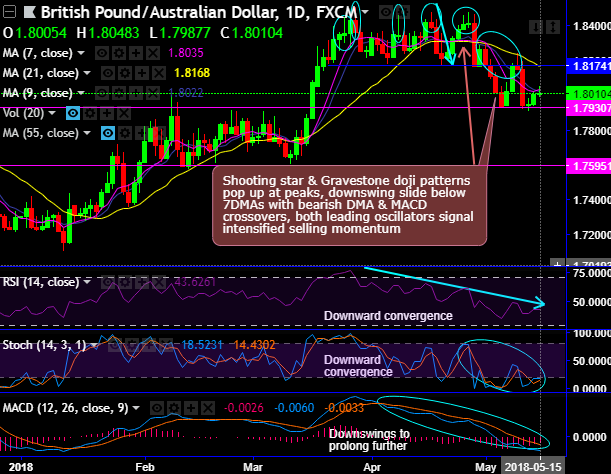

We spotted out shooting star, gravestone doji and bearish engulfing patterns. These bearish patterns have occurred at peaks of rallies at 1.8408, 1.8412 and 1.8167 respectively and have evidenced considerable slumps in this pair.

The downswing slide below 7DMAs with bearish DMA and MACD crossovers, both leading oscillators signal intensified selling momentum (refer daily charts).

As you could probably observe on weekly plotting, the bull swings seem to have been totally exhausted at channel resistance. Shooting stars occur at 1.8259, 1.8249 and 1.8167 levels and gravestone doji at 1.8336 levels. Ever since then, steep slumps have been evidenced.

For today, the bullish rally is not convincingly supported by both leading and lagging indicators, thus, trend and momentum in this bullish sentiment has still been dubious. The lingering bears are all set to break below strong support zones 1.7930 levels.

Trade tips: Contemplating lingering bearish technical indications, amid today’s rallies, at spot reference: 1.7998, one can speculate this pair by building boundary options spread with upper strikes at 1.8085 and lower strikes at 1.7930 levels.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned into -120 (which is bearish), while hourly AUD spot index was at shy above 14 (neutral) while articulating (at 08:32 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand