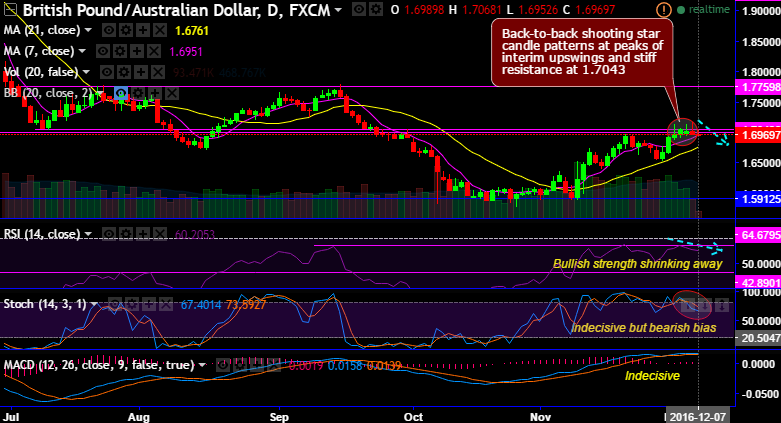

On daily charts, back-to-back shooting star candle patterns are traced out at peaks of interim upswings and stiff resistance at 1.7043.

Shooting stars are appeared at 1.6978, 1.7036 and yesterday again at 1.6989.

From the last couple of days, the previous upswings have been struggling to break the stiff resistances of 1.7050 levels. Historically, you could find the demand and supply pressures at the same junctures (Refer daily chart).

RSI at 65 levels indicates that the bullish strength shrinking away, while stochastic curves have little indecisive, but %D crossover at 80s which is overbought territory signals selling momentum.

MACD has been indecisive to confirm this bearish sentiment but on the flipside, neither does it indicate bullish extension also.

The current prices are attempting slide below 7DMA, any slide below this levels would be deemed as the opportunities for the bearish targets.

On weekly plotting, you could observe that the intermediary bulls struggle to break and sustain above stiff resistance of 1.70 levels.

Trade tips:

The FxWirePro Currency GBP Index indicates extremely bearish sentiments after the disappointing manufacturing production data (actual -0.9% versus previous 0.6% and forecasts at 0.2%), While AUD index also weakened after Q3 GDP posted an unexpected drop (The GDP fall, the biggest since 2008, is likely one of the biggest forecasting misses by the Reserve Bank of Australia), so, certainly not that considerable bullish signal in long run for sure, simultaneously, GBP has been bearish for now.

Intraday speculators, you could also effectively utilize FxWirePro currency strength index that measures the performance of the basket of eight currencies on an hourly basis.

GBP index value -110.264 (while articulating), AUD index value 14.6167.

Please refer below weblink for more details on indices:

http://fxwirepro.com/currencyindex

Contemplating the above technical reasoning we could see the trading opportunities in tunnel spreads that are binary versions of debit put spreads.

Upper strikes – 1.7050, downward strikes – 1.6850.

This strategy seems best suitable on intraday speculative grounds for certain yields but with leveraging effects. But in long run, one has to wait and sit with hedging plans for the better clarity.