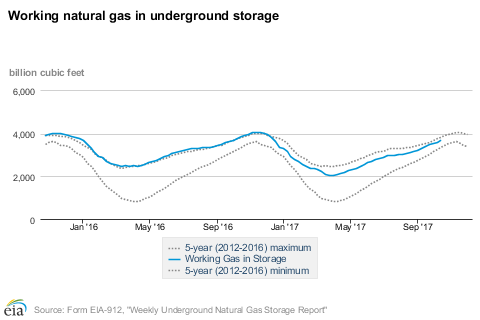

Last night’s inventory report published by the U.S. Energy Information Agency (EIA) showed that the natural gas inventory level has touched 3.65 trillion cubic feet as of October 13th, just shy of last year’s record high above 4 trillion cubic feet. See Chart 1 There are still 3-4 weeks of inventory buildup due before the winter drawdown begins. We suspect that even if the working gas in underground storage doesn’t hit a record high this year, it will be close to 3.9 trillion cubic feet, just shy of the record.

In an article back in August, named, “FxWirePro: Natural gas outlook changed from bearish to very bearish”, available at http://www.econotimes.com/FxWirePro-Natural-gas-outlook-changed-from-bearish-to-very-bearish-844473 we changed our outlook to very bearish citing higher global supplies. However, our stop loss for the bear trade at $3.12 got hit in a false bullish breakout. After which the price declined sharply and Natural gas is currently trading at $2.89 per MMBtu.

Since June, Natural gas has been trading in a narrow range of $2.75 and $3.15 per MMBtu. We still remain bearish on gas, however, the actual direction would very much depend on the actual winter and demand.

U.S. National Oceanic and Atmospheric Administration (NOAA) has forecasted that La Niña is expected to be back and it might wreck the winter in North America. Hence the winter is expected to be much warmer.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX