The USD has continued to make fresh highs as the combination of ongoing global cyclical disappointment, and relative US cyclical outperformance adds fuel to the unwind of USD shorts. 63% of the extreme short dollar base seen earlier this year has unwound, similar to the proportion of the extreme dollar discount unwind, which now shows the USD only 4.7% cheap versus 5y rate spreads, from near 13% in mid-February.

Watching for cracks in the USD correlation wall: The re-syncing of US rates and the dollar has spurred across- the board USD strength over the past month, and there are few signs yet that indiscriminate dollar buying is giving way to greater differentiation (80% -100% of G10 and EM currencies have weakened vs the greenback over 1-wk, 2wk and 1-mo trailing windows).

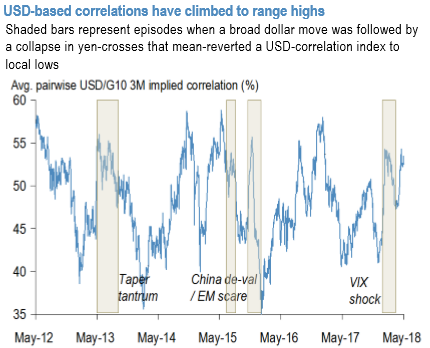

The natural corollary of a universal dollar rally is that USD-based implied correlations have climbed to near range highs (refer 1st chart), and are worth watching for cracks as a gauge of whether risk sentiment is worsening.

One oft-repeated FX pattern during risk-off episodes is an initially broad USD surge, followed by an even more intense bout of deleveraging characterized by a cratering of yen-crosses and breakdown in JPY/high-beta correlations that mean-reverts a USD-correlation index to its local lows –see shaded bars in (refer 1st chart) for examples; notably, this was also the experience of the taper tantrum episode that the current bout of Treasury weakness is being increasingly likened to, when the Abenomics/QQE-I fueled uptrend in USDJPY was rudely interrupted by a serious bout of cross-yen selling.

We have been running GBPJPY vs USDJPY and BRLJPY vs USDBRL vega spreads in our model portfolio for a while now as protection against such disorderly price action. At current levels, directional investors could consider JPY put/KRW call spreads or digitals that are well-priced within the subset of defensive cross-yen plays (refer 2nd chart) e.g. 3M 10.20 strike digital JPY calls offer 5.5 times gearing (spot ref. 9.72). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly JPY spot index has shown 158 (which is highly bullish), while hourly USD spot index was at 2 (absolutely neutral) while articulating at 09:17 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand