The Swiss National Bank (SNB) has exhausted with an average of CHF 1.2bn. per week on FX market interventions in 2016, sources say. As a result, the Swiss central bank contributed decisively to keeping the EURCHF exchange rate above the 1.08 mark until October 2016.

Without its conformity, the exchange rate seems unlikely to have dropped to levels around 1.07. The appreciation pressure resting on the franc is undiminished as the continuous need for interventions illustrates.

However, it is unwise to admit the SNB going liberal with a remarkably stronger CHF near-term. The economic and inflationary trends remain too unstable for the SNB to be able to sit back and relax.

Even now the franc is putting pressure on the exporters’ margins and according to a newspaper poll amongst companies, the job cuts become more likely from their point of view – the strong rise of the PMI (the December index will be published today) could soon ease. And provide the SNB with an additional reason to continue to prevent CHF strengthening.

OTC Outlook and Hedging Framework:

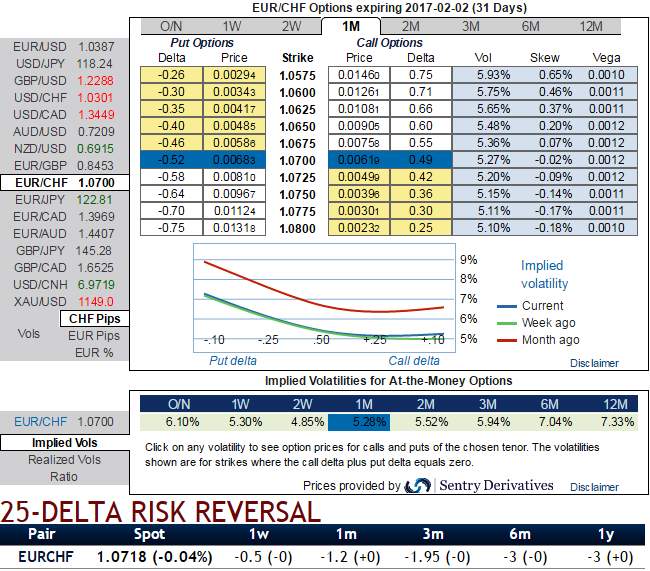

Long lasted range bounded trend between upper strikes 1.1122 and lower strikes at around 1.0684 levels now comes to an end: EURCHF’s range bound pattern now seems like breaking out to make southward targets as bearish patterns with selling momentum are indicating weakness on both short and medium terms.

Please be informed that the implied volatilities of EURCHF ATM contracts of all expiries have still been the least among G10 currency segment. While positively skewed 1m IVs suggest the OTM put are on higher demand.

While, the 25-delta risk of reversal of EURCHF has also been indicating bearish pressures both in short and long run, seems to be one of the pairs to be hedged for downside risks as it indicates puts have been relatively costlier.

FX Option Trading Strategy:

Strategy: 3-Way Diagonal Straddle versus OTM Call

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in EURCHF 1M at the money -0.49 delta put, long in 1M at the money +0.51 delta call and simultaneously, Short theta in 2w (1.5%) out of the money call with positive theta or closer to zero. Theta is positive; time decay is bad for a buyer, but good for an option writer.

Rationale: Let’s glance on sensitivity tool for put options of this pair, it flashes up higher probabilistic numbers for OTM put strikes which would mean that higher likelihood of expiring these contracts in-the-money, hence, it wise to deploy positions against this signals (i.e writing an OTM call with shorter tenors).

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.