The campaign surrounding the EU referendum is on the home straight. In less than 24 hours, the polling stations will open and the British electorate will start to decide on the membership of Great Britain in the EU.

Following a veritable tug of war between the remain - and the exit-supporters over the past few weeks, the outcome of the referendum is completely open again just a day before the vote. Even though the remain-camp had a small lead in most polls compiled over the past few days, the leave-camp had recorded a lead of up to 10% in some of the polls compiled in the previous two weeks.

The fact that a YouGov poll put the leave camp in the lead again now when only two days earlier a poll by the same pollster had seen a slight advantage for the remain camp is also worrying.

A long position on TRY volatility may function as an insurance vehicle against the “Brexit” risk.

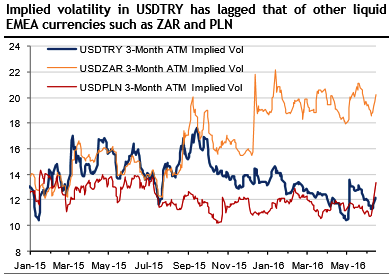

Notably, volatility in the Turkish lira has lagged behind those of other liquid EMEA currencies such as ZAR and PLN, and we expect that TRY volatility may engage in some catch-up.

Additionally, we believe that political risks may be currently understated in Turkey, in light of the administration’s move toward implementing an executive presidency, a heightened risk of snap elections, and the worrying frequency of on-going terrorist attacks.

Turkey's GDP expanded 0.8 pct on the quarter in the first three months of 2016, slowing from an upwardly revised 1.2 pct expansion in the previous period and boosted by household consumption and government spending; while a contraction in fixed investment dragged expansion down

Although not our base case scenario, we note that aggressive easing by the Central Bank of the Republic of Turkey (CBRT) over the coming months or negative China newsflow may also spill over into heightened volatility in USDTRY, alongside some TRY deterioration.

We recommend a long volatility position via a 3-month at-the-money call option on USDTRY vol, which currently costs 2.6104% in premium (ATMD strike of 2.9816).

This position will benefit if implied volatility continues to rise, or if TRY weakens against USD over the coming months. With 3-month implied volatility currently at 12.11, we target a move higher to 14.11, combined with 3% deterioration in TRY spot.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed