Short 6M in 1Y time FVAs in USD/BRL: Since Funding valuation adjustment is essentially the funding cost/benefit resulting from borrowing or lending the shortfall/excess of cash arising from day-to-day derivatives business operations (for an instance, posted and received collateral).

These collaterals are radically contrarian position that should sustain in reasonably well even if we do get the 6% drop in the real that it is pencilled in for H1.

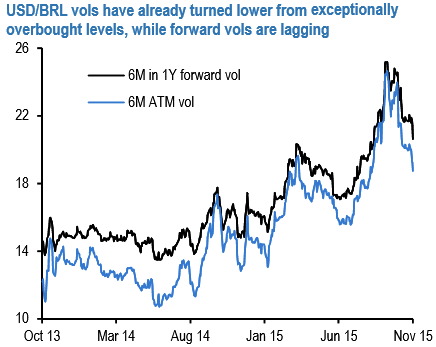

ATM vols in USD/BRL have already turned lower from remarkably overbought levels aided by soft realized performance in recent weeks (3-4 pts. under) yet forward vols are lagging and are priced 2-2.5 vols above.

We would not like to disregard the probabilities of vol bouncing back again in the short run, and BRL spot FX certainly can swing wildly in a way that would make selling realized vol (gamma) a distinctly uncomfortable stance to take.

But think that 20-handle forward vols will have a hard time realizing by the end of the year when greater clarity would have emerged on Brazilian politics and EM overall would have settled down after initial Fed-related tremors.

Hence our decision to take gamma out of the equation via an FVA short that benefits from implied vols falling short of what forwards price in by end-2016.

FxWirePro: FVAs in USD/BRL as vols turning lower in H1 2016

Tuesday, January 19, 2016 2:25 PM UTC

Editor's Picks

- Market Data

Most Popular

3

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary