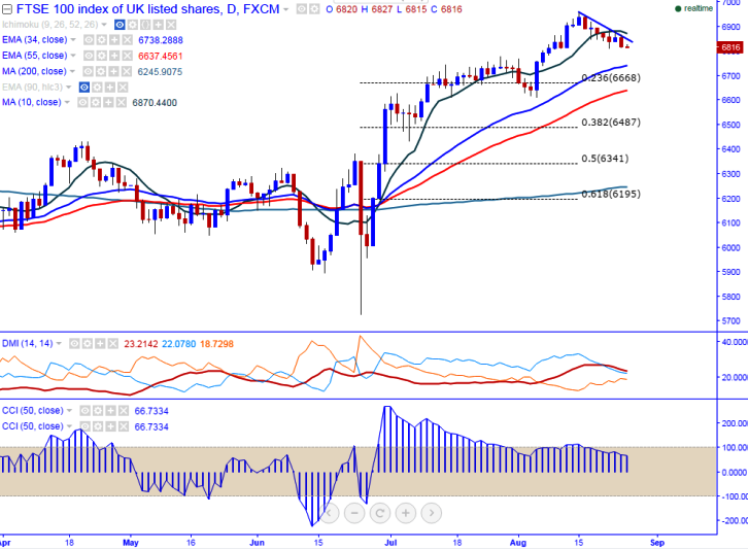

- Major resistance – 6956 (Aug 15th 2016 high).

- Major support – 6800.

- The index formed a temporary top around 6956 on Aug 15th and started to decline from that level. It is currently trading around 5818.

- Short term trend is weak as long as resistance 6880 (10 –day MA) holds. Any break above 10-day MA will take the index to next level till 5955/6000.

- On the lower side, support stands at 6800 and break below will drag the index down till 6730 (34- day EMA)/6668 (23.6% retracement of 5727 and 6956).

It is good to sell on rallies around 6825-6830 with SL around 6880 for the TP of 6730/6670